Una lista de verificación paso a paso

Si la ayuda financiera otorgada a su estudiante no refleja la verdadera situación financiera de su familia, puede apelar. Una apelación al juicio profesional es una parte estándar del proceso de ayuda financiera. Los fondos de apelación pueden ser limitados, por lo que cuanto antes envíe una apelación completa y bien documentada, mayores serán sus posibilidades de obtener una nueva adjudicación.

Paso 1: Investigue el proceso de apelación de la universidad

Cada universidad gestiona las apelaciones de forma diferente. Comprender su proceso específico antes de empezar le ahorrará tiempo y evitará que su apelación se retrase o sea rechazada por un tecnicismo.

- Vaya al sitio web de ayuda financiera de la universidad y busque su sección de apelaciones.

- Busque términos como “circunstancias especiales”, “juicio profesional” o “apelación de ayuda financiera” junto con el nombre de la escuela.

- Tenga en cuenta si requieren un formulario específico, un envío a través de un portal en línea o una carta.

- Revisar qué circunstancias suelen considerar y cuáles no.

- Tenga en cuenta cualquier fecha límite o requisito de documentación.

Muchas universidades ahora enumeran claramente en su sitio web las circunstancias que considerarán y las que no. Esto te ayuda a centrar tu apelación en lo que más le importa a esa universidad en particular.

Paso 2: Identifica y organiza tus circunstancias especiales

Si su situación no aparece en el sitio web de la universidad, puede presentar una apelación explicando cómo afecta sus finanzas familiares y su capacidad para pagar la universidad. Concéntrese en circunstancias fuera de su control, no en decisiones de estilo de vida discrecionales.

Organice su apelación en categorías:

1. Cambios en los ingresos: pérdida de empleo, reducción de salario, jubilación, fin de la manutención infantil o de los beneficios del Seguro Social, ingresos volátiles o estacionales, o cualquier cambio que haga que sus ingresos actuales parezcan diferentes de lo que muestra su declaración de impuestos.

2. Gastos extraordinarios o gravosos: costos médicos y dentales no reembolsados, cuidado de un familiar con necesidades especiales o de edad avanzada, clases particulares de K-12 para hermanos, gastos relacionados con discapacidades, honorarios legales elevados o reparaciones o pérdidas del hogar.

- Enumere cada circunstancia especial que se aplique a su familia.

- Para cada uno, anote los montos específicos en dólares y el impacto financiero.

- Divida las categorías grandes; por ejemplo, separe los gastos médicos en primas de seguro, recetas, procedimientos y costos de bolsillo.

Paso 3: Escriba su carta de apelación

Limítate a una o dos páginas. Sé específico, objetivo y educado. La oficina de ayuda financiera es, en esencia, quien toma la decisión final.

- Comience con gratitud por el premio existente y el interés de su estudiante en la universidad.

- Resuma cada circunstancia especial con fechas y montos en dólares.

- Explique el impacto financiero en la capacidad de pago de su familia

- No solicite un monto específico en dólares: deje que la oficina de ayuda financiera determine el ajuste

- Cerrar agradeciendo al administrador por su consideración.

Siempre que sea posible, dirija su carta a una persona específica. Llame a la oficina de ayuda financiera o consulte el sitio web para obtener el nombre del director o de la persona encargada de las apelaciones.

Paso 4: Recopilar y adjuntar documentación

La documentación independiente de terceros refuerza su apelación y podría ser necesaria. Las oficinas de ayuda financiera necesitan evidencia objetiva para justificar el aumento de su beca.

- Reúne documentos para cada circunstancia a la que hagas referencia en tu carta.

- Los ejemplos incluyen avisos de despido o terminación, facturas médicas y dentales, extractos de cuentas bancarias, recibos, declaraciones de impuestos y formularios W-2.

- Envíe siempre copias, nunca originales

- Etiquete claramente cada documento con el nombre de su estudiante

Paso 5: Ejecute la calculadora de precio neto

La Calculadora de Precio Neto (NPC) en el sitio web de la universidad le permite estimar el monto que podría recibir si se acepta su apelación. Ingrese su información financiera actualizada para ver la posible diferencia.

- Ejecute el NPC con la información financiera que envió en su FAFSA o Perfil CSS

- Vuelva a ejecutarlo con la nueva información financiera que está enviando en la apelación.

- Compare el resultado estimado con su premio actual

- Utilice estos resultados en su apelación, pero lo que es más importante, utilícelos para comparar posibles premios revisados entre universidades.

Paso 6: Presentar a cada universidad y dar seguimiento

Envía tu solicitud a todas las universidades donde deseas una evaluación, no solo a tu primera opción. Confirma la recepción y mantente informado.

- Envíe su carta, documentación y cualquier formulario requerido a cada universidad.

- Siga el método de envío que requiere cada universidad (portal, correo electrónico o correo postal)

- Llame a la oficina de ayuda financiera aproximadamente una semana después de enviar la solicitud para confirmar la recepción.

- Pregunte si necesitan información adicional para completar la revisión.

Las apelaciones se pueden presentar en cualquier momento, incluso a mitad de año, y vale la pena volver a presentarlas cada año académico si las circunstancias persisten.

Calculadora del índice de ayuda estudiantil (SAI) de la FAFSA 2026-27

¿Qué es el Índice de Ayuda Estudiantil?

La FAFSA 2026-27, o Solicitud gratuita de ayuda federal para estudiantes, es la solicitud principal de ayuda financiera basada en la necesidad para el año académico 2026-27. Un estudiante y uno o más padres presentan información financiera y del hogar. Con base en esta información, la FAFSA calcula la cantidad que una familia puede pagar por la universidad en un año determinado, llamada... Índice de Ayuda Estudiantil (SAI).

La oficina de ayuda financiera de una universidad utiliza el Índice de ayuda estudiantil En la siguiente ecuación simple, para determinar la elegibilidad de un estudiante para recibir ayuda financiera según la necesidad, dada la universidad Costo de asistencia.

Costo de asistencia

Índice de Ayuda Estudiantil (SAI)

_____________________________

= Necesidad financiera

Un estudiante Necesidad financiera es su elegibilidad para obtener ayuda en una universidad. Sin embargo, las políticas de cada universidad sobre la asignación de sus fondos institucionales basados en las necesidades determinan la oferta de ayuda financiera que finalmente recibirá un estudiante, que puede o no cumplir con las necesidades calculadas del estudiante. Necesidad financiera. Leer más

¿Cómo se calcula el Índice de Ayuda Estudiantil?

El tamaño de la familia, el estado civil de los padres, el estado de residencia, junto con cuatro factores financieros principales, determinan el Índice de Ayuda Estudiantil 2026-27.

- Ingresos de los padres en 2024

- Activos de los padres en la fecha de presentación

- Ingresos del estudiante 2024

- Activos del estudiante en la fecha de presentación

Un cambio significativo es que el número de estudiantes universitarios ya no se utilizará en la fórmula SAI.

1) Ingresos de los padres

La FAFSA 2026-27 se basa en las declaraciones de impuestos federales de 2024 para todos los ingresos de los padres, lo que elimina la necesidad de declarar ingresos no tributables que no se incluyen en las declaraciones de impuestos federales. Las contribuciones antes de impuestos a planes de jubilación patrocinados por el empleador (401k, 403b, pensión, etc.) ya no se consideran parte de los ingresos de los padres.

Si el padre o la madre no está obligado a presentar declaraciones de impuestos federales en 2024, el SAI será de -$1,500. Este paso se incluye en esta calculadora. Leer más

2) Activos de los padres

La FAFSA 2026-27 contabiliza los siguientes activos como parte del patrimonio neto de un padre disponible para pagar la universidad:

- De cheques

- Cuentas de ahorro/mercado monetario

- CD

- Cuentas de corretaje

- 529 o planes de ahorro para la universidad solo para el estudiante solicitante

- Valor patrimonial de segundas propiedades.

Se pueden contabilizar dos categorías adicionales como activos principales para el cálculo del SAI.

- Manutención infantil recibida.

Un padre declara toda la manutención infantil recibida durante el año calendario anterior a la presentación de la FAFSA como un activo. - Patrimonio neto del negocio o finca.

Si un padre o madre es propietario de un negocio o finca con más de 100 empleados a tiempo completo, el patrimonio neto se declara en la FAFSA. El patrimonio neto es el valor del negocio o finca menos cualquier deuda contraída con él. Un padre o madre que solo sea copropietario declararía su porcentaje del patrimonio neto total.

Activos protegidos son no contado en la FAFSA:

- Cuentas de jubilación: 401k, 403b, IRA, pensiones, etc.

- Seguro de vida

- Vivienda principal

La tasa de contribución del patrimonio neto total de los activos de los padres reportada es de aproximadamente 5%.

3) Ingresos estudiantiles

La FAFSA 2026-27 ofrece protección de ingresos para estudiantes de $11,770. Por lo tanto, no se prevé ninguna contribución de los ingresos del estudiante si los ingresos de 2024 son de $11,770 o menos. Por cada dólar que supere esta cantidad, la tasa de contribución es 50%.

4) Activos estudiantiles

Se declaran todos los activos que posee un estudiante fuera de su jubilación. Estos incluyen cuentas corrientes, de ahorro, certificados de depósito y cuentas de corretaje. Los planes 529 o de ahorro para la universidad que posee el estudiante siempre se declaran como activo principal. La tasa de contribución para los activos estudiantiles es de 20% por cada dólar.

Calculadora del índice de ayuda estudiantil FAFSA 2026-27

Para calcular su índice de ayuda estudiantil, utilice los valores de las declaraciones de impuestos de 2024 de los padres y del estudiante y el valor actual de los activos de los padres y del estudiante. Nota: Esta calculadora es para estudiantes dependientes.

¿Cómo se desarrolló esta calculadora?

Esta calculadora sigue la fórmula actualizada del Índice de Ayuda Estudiantil 2026-27 publicada por el Departamento de Educación en agosto de 2025. Puede descargar la hoja de fórmulas. aquí.

¿Qué significa un SAI negativo?

El Índice de Ayuda Estudiantil ahora puede ser tan bajo como -$1,500. Para determinar la elegibilidad de un estudiante (Costo de asistencia – SAI = Necesidad financiera/Elegibilidad), las universidades establecerán el SAI en $0. Sin embargo, la universidad podría considerar un SAI negativo al evaluar los programas universitarios para estudiantes con alta necesidad.

Necesidad demostrada y políticas de ayuda financiera de las universidades: una calculadora

¿Qué es la necesidad demostrada?

Tu Necesidad Demostrada es la cantidad de ayuda financiera basada en la necesidad a la que puedes ser elegible. Cada universidad determina tu Necesidad demostrada, o elegibilidad para ayuda financiera, utilizando esta ecuación fundamental:

Costo de asistencia

– Índice de ayuda estudiantil (La capacidad de pago está determinada por la FAFSA o el Perfil CSS)

_____________________________

= Necesidad demostrada o elegibilidad para ayuda basada en la necesidad

Las universidades que solo requieren la FAFSA utilizan el Índice de Ayuda Estudiantil (SAI) de la FAFSA para medir la capacidad de pago de una familia y determinar si el estudiante cumple los requisitos para recibir ayuda institucional basada en la necesidad. Las universidades que requieren el Perfil CSS calculan un Índice de Ayuda Estudiantil (SAI) personalizado para medir la capacidad de pago de una familia y determinar si el estudiante cumple los requisitos para recibir ayuda institucional basada en la necesidad.

¿Cómo saber tu Índice de Ayuda Estudiantil?

Puede calcular su índice de ayuda estudiantil de FAFSA utilizando el Calculadora SAI del método de dinero universitarioPara el Perfil CSS, no existe una calculadora general de SAI, ya que cada universidad puede personalizar los datos y las fórmulas. Para comprobar si cumple los requisitos para el Perfil CSS, se recomienda usar la Calculadora de Precio Neto de cada universidad con Perfil CSS.

¿Cuál es el porcentaje de necesidad satisfecha?

Si bien es posible que tengas cierta necesidad demostrada en una universidad, esto no significa que recibirás una ayuda financiera que la iguale. Muchas universidades no tienen la capacidad de ofrecer una ayuda financiera que cubra todas las necesidades de un estudiante.Lea más aquíAfortunadamente, las universidades publican datos anuales sobre el porcentaje de necesidades que cubren en promedio. Con esta información, puedes saber con antelación cuán generosa es la universidad con sus ofertas de ayuda financiera según la necesidad.

Necesidad demostrada

x Porcentaje de necesidad satisfecha

_____________________________

= Oferta de ayuda financiera anticipada

Tomemos un ejemplo. La Universidad Chapman cubre, en promedio, el 75% de necesidad demostrada. Si su FAFSA SAI es igual a $22,000, dado su costo de estudio de $87,730, su necesidad demostrada es igual a $40,700 ($87,730 – $22,000). Sin embargo, dado que, en promedio, Butler ofrece un paquete de ayuda financiera que cubre el 70% de esa necesidad, debería esperar una oferta de ayuda financiera de aproximadamente $28,500 (70% de $40,700). Esto le deja un margen en la oferta de ayuda financiera de $12,200, lo que representa un costo adicional de bolsillo que se suma a su Índice de Ayuda Estudiantil de $22,000.

La calculadora de necesidad demostrada

Es fundamental comprender qué universidades ofrecen un margen de ayuda financiera adicional y en qué medida, para que puedas planificar estos costos adicionales. Puedes usar esta calculadora para explorar las políticas de ayuda financiera de las universidades que utilizan la FAFSA y su impacto en tu capacidad de pago prevista.

Cambios en los préstamos Parent PLUS

¿Qué es el Préstamo PLUS para Padres?

El Préstamo PLUS para Padres es ofrecido por el Departamento de Educación a los padres que solicitan un préstamo para la educación universitaria de un estudiante.

El umbral de calificación para el Préstamo PLUS para Padres es menor que para los préstamos privados. Las ofertas de préstamos privados se basan en la calificación crediticia del prestatario o su relación deuda-ingresos. Los Préstamos PLUS para Padres solo exigen que el prestatario no tenga un historial crediticio negativo, como una quiebra en los últimos 7 años o un impago de deudas vigente de 90 días.

Para obtener más información sobre el Préstamo PLUS para Padres, incluidas las tasas de interés actuales, consulte el Recursos del Departamento de Educación.

¿Qué está cambiando?

Los límites de préstamos tienen nuevos límites, el plan de pago está limitado a la opción de pago estándar y el Préstamo PLUS para padres ya no calificará para los programas de condonación de préstamos federales.

| Año de adjudicación 2026-27 y posteriores | |

| Préstamo Límites | Los préstamos PLUS para padres tienen un límite de $20,000 por año y un total de $65,000 para la educación universitaria de un estudiante. |

| Reembolso Planes | Los Préstamos PLUS para Padres deben seguir en la opción de Pago Estándar. Los Préstamos PLUS para Padres ya no son elegibles para planes de Pago Basados en los Ingresos. |

| Préstamo Perdón | Los préstamos PLUS para padres ya no son elegibles para ninguna condonación de préstamos federales, incluida la condonación de préstamos por servicio público (PSFL). |

¿Cuando se producen los cambios?

A partir del 1 de julio de 2026, estos cambios afectarán a los Préstamos PLUS para Padres del Año de Concesión 2026-27 en adelante. Los padres que soliciten un préstamo por primera vez después de esta fecha estarán sujetos a estos nuevos términos. Los Préstamos PLUS para Padres desembolsados antes del 1 de julio de 2026 seguirán sujetos a los términos actuales.

Datos de ayuda basados en el mérito

Fomentar la asequibilidad con ayuda al mérito universitario

Cuando un estudiante no cumple los requisitos para recibir ayuda financiera basada en la necesidad, las becas al mérito otorgadas por una universidad pueden ser una forma significativa de reducir costos y aumentar la asequibilidad. Las becas al mérito se otorgan principalmente a través del proceso de admisión como incentivo para que los estudiantes se matriculen, sin criterios de necesidad.

Cómo medir la generosidad por mérito de una universidad

Hay dos maneras de entender la generosidad de una universidad con las becas por mérito: 1) la cantidad de estudiantes que reciben becas por mérito y 2) el tamaño de estos premios.

El número de premios

Las universidades varían ampliamente en la cantidad de becas al mérito que otorgan: hay universidades que no ofrecen becas al mérito y universidades que otorgan un descuento por mérito a todos los admitidos.

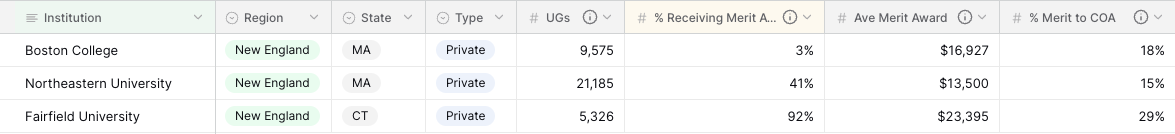

Los DATOS:Las universidades publican el porcentaje de estudiantes que lo hacen no Si califica para ayuda basada en la necesidad y aun así recibe una beca por mérito, esto se puede encontrar en la columna % recibe premios al mérito.

Un estudiante que busca ayuda basada en el mérito puede comprender que las posibilidades de recibir una beca de Boston College (3%) son muy poco probables, de Northeastern (41%) son posibles y de Fairfield (92%) ciertamente están garantizadas.

El tamaño del premio

Es fundamental comprender el monto de la beca que una universidad puede ofrecer para garantizar que sea suficiente para que el precio neto sea asequible.

LOS DATOS: Las universidades publican la beca promedio por mérito que reciben los estudiantes sin necesidad económica. Esta información se puede consultar en la columna Premio al mérito de AveTambién es útil comprender qué porcentaje del costo de asistencia cubre la beca de mérito promedio. Esto se puede encontrar en la columna % Mérito al COA.

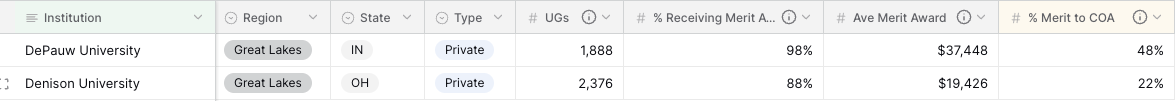

Si bien un estudiante admitido tanto en DePauw como en Denison seguramente recibiría una beca al mérito en el proceso de admisión, existe una diferencia significativa en el monto de la beca. La beca promedio de DePauw, de $37,448, cubre casi 50% del costo de la matrícula, mientras que la beca promedio de Denison, de $19,426, cubre poco más de 20%.

Datos universitarios del conjunto de datos comunes 2024-25

Utilice esta base de datos en línea para explorar la generosidad de las universidades con ayuda basada en el mérito.

Consejos:

- FILTRAR:Al utilizar la columna Filtro para Región o Estado, elija la opción es cualquiera de Opción para seleccionar múltiples regiones o estados.

- ICONO DE INFORMACIÓN:El icono de información junto al nombre de la columna proporciona una descripción más detallada de los datos presentados.

- DESCARGAR:Para descargar una copia, haga clic en los 3 puntos y seleccione Exportar a CSVGuardará el archivo con los cambios realizados. Nota: No recomiendo descargarlo a Excel, ya que convertirá los campos numéricos, como porcentajes y dólares, en campos de texto.

Datos de ayuda financiera según la necesidad

No todas las universidades pueden satisfacer las necesidades de sus estudiantes.

De hecho, solo 70 de las más de 460 universidades de la lista a continuación cumplen con el requisito 100% de necesidad o elegibilidad para ayuda.

¿Por qué las universidades dejan de brindar ayuda financiera?

Hay dos razones clave por las que la oferta de ayuda financiera de una universidad puede no coincidir o igualar la elegibilidad de ayuda de su estudiante.

La mayoría de las universidades no tienen suficientes recursos.

La mayoría de las universidades ofrecen un premio que es sólo un porcentaje de la elegibilidad del estudiante, lo que genera una brecha en la oferta de ayuda financiera.

Los DATOS:Las universidades publican el porcentaje de necesidad o elegibilidad que cumplen en promedio, que se puede encontrar en los datos a continuación en la columna % de Necesidad Satisfecha.

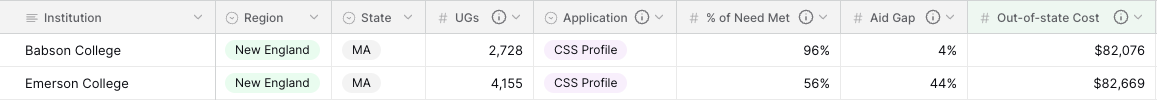

Si un estudiante fuera elegible para recibir $$30,000 en ayuda financiera basada en la necesidad tanto en Babson como en Emerson, el estudiante esperaría recibir casi $$30,000 de Babson (con $96%), pero solo alrededor de $$15,000 de Emerson (con $56%).

Las universidades públicas sólo financian a sus estudiantes residentes.

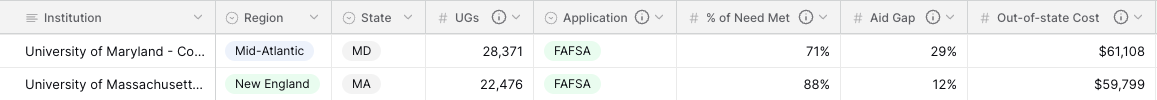

Las universidades públicas solo otorgan ayuda financiera institucional basada en la necesidad a sus estudiantes residentes del estado. Los estudiantes admitidos fuera del estado deben esperar no recibir ayuda institucional basada en la necesidad, lo que resulta en una gran brecha de ayuda.

LOS DATOS: Debes asumir 0 % de Necesidad Satisfecha, excepto las opciones de ayuda federal. Las cifras de las universidades públicas que se indican a continuación reflejan el porcentaje de necesidades cubiertas para sus estudiantes residentes en el estado.

Un estudiante de Maryland admitido en la Universidad de Massachusetts Amherst no tendría cubiertas sus necesidades. Pagaría el costo total de residencia fuera del estado, que asciende a casi 60.000 dólares, excepto por becas al mérito o ayuda federal.

Datos universitarios del conjunto de datos comunes 2024-25

Utilice esta base de datos en línea para explorar la generosidad de las universidades con ayuda financiera basada en la necesidad.

Consejos:

- FILTRAR:Al utilizar la columna Filtro para Región o Estado, elija la opción es cualquiera de Opción para seleccionar múltiples regiones o estados.

- ICONO DE INFORMACIÓN:El icono de información junto al nombre de la columna proporciona una descripción más detallada de los datos presentados.

- DESCARGAR:Para descargar una copia, haga clic en los 3 puntos y seleccione Exportar a CSVGuardará el archivo con los cambios realizados. Nota: No recomiendo descargarlo a Excel, ya que convertirá los campos numéricos, como porcentajes y dólares, en campos de texto.

Apoyo financiero para familias afectadas por los incendios del sur de California

Estos recursos se ofrecen para apoyar a las familias con estudiantes que cursan sus estudios universitarios en el área de Los Ángeles afectada por los incendios forestales de enero de 2025. Las oficinas de ayuda financiera universitaria desean comprender los cambios en su situación financiera como resultado de este desastre natural para evaluar integralmente sus necesidades financieras y otorgar ayuda según sus necesidades.

A través de una solicitud de ayuda financiera, puede enviar nueva información sobre el impacto financiero de este evento para complementar y modificar la información presentada en la FAFSA o el Perfil CSS. Mediante un proceso conocido como Juicio profesionalLa oficina de ayuda financiera de la universidad incluirá nuevos factores como reducción de ingresos, gastos extraordinarios y pérdida de activos en su evaluación o reevaluación de su elegibilidad y concesión de ayuda financiera.

Es importante abogar por estos cambios y participar en este proceso desde el principio. Empieza con estos recursos y colabora con tu consejero universitario para obtener apoyo. Contacta con las oficinas de ayuda financiera; están ahí para ayudarte.

Grabación del taller

Este taller se grabó el 18 de febrero de 2025, en asociación con las escuelas LAISCC.

Plantilla de carta de solicitud de ayuda financiera

Utilice esta carta de apelación como modelo para solicitar un ajuste a la ayuda financiera. Adapte el texto para que refleje mejor sus circunstancias personales. en cursiva Las secciones son indicaciones para escribir.

Preguntas y respuestas

Estas son las preguntas que hicieron las familias durante nuestro taller, junto con las respuestas y la orientación brindadas.

Límites de ingresos para recibir la Beca Pell

¿Cómo se determina la elegibilidad para la Beca Pell?

Beca Pell máxima

La FAFSA determina si el estudiante califica para la Beca Pell Máxima con base en dos factores: 1) el Ingreso Bruto Ajustado (AGI) de los padres más el Monto de Exclusión por Ingresos Extranjeros en el año base, el tamaño de la familia y el estado de residencia, y 2) el Índice de Ayuda Estudiantil (SAI) calculado para el estudiante. Cuando el AGI de un padre más el Monto de Exclusión por Ingresos Extranjeros es igual o inferior a los límites basados en el estado civil y el tamaño de la familia en el año base, tablas a continuaciónEl estudiante podría calificar para la Beca Pell Máxima. El Congreso determina anualmente la Beca Pell Máxima, y se espera que el monto para el año académico 2026-27 sea de $7,395.

A partir de la FAFSA 2026-27, todos los estudiantes recibirán un Índice de Ayuda Estudiantil (SAI) calculado. Si el SAI es más del doble del monto máximo de la Beca Pell para 2026-27 (o $14,790), el estudiante no será elegible para recibir la Beca Pell, aunque el Ingreso Bruto Ajustado (AGI) de sus padres más el Monto de Exclusión por Ingresos Extranjeros sea igual o inferior al monto que se indica en la tabla a continuación.

Beca Pell parcial

Un estudiante puede recibir una Beca Pell parcial cuando el Ingreso Bruto Ajustado (AGI) más el Monto de Exclusión por Ingresos Extranjeros (MIE) de sus padres supere los límites indicados a continuación. Esta Beca Pell parcial se calcula con base en el Índice de Ayuda Estudiantil (IAE). Si el IAE es inferior a la Beca Pell Máxima, el estudiante podría recibir la diferencia entre ambos.

Límites máximos de ingresos para la Beca Pell

Esta tabla proporciona los límites de ingresos de los padres para un estudiante dependiente para los tres ciclos de FAFSA: FAFSA 2025-26, FAFSA 2026-2027 y FAFSA 2027-28.

Límites de ingresos de la FAFSA 2025-26

por estado civil y tamaño de la familia para los 48 estados inferiores

| Tamaño de la familia | padre soltero con un ingreso bruto ajustado (AGI) de 2023 igual o inferior | Padre casado con un ingreso bruto ajustado (AGI) de 2023 o inferior |

|---|---|---|

| 2 | $44,370 | N / A |

| 3 | $55,935 | $43,505 |

| 4 | $67,500 | $52,500 |

| 5 | $79,065 | $61,495 |

| 6 | $90,630 | $70,490 |

| 7 | $102,195 | $79,485 |

| 8 | $113,760 | $88,480 |

| Para un padre soltero, el umbral de AGI se basa en 225% del nivel de pobreza federal de 2023, dado el tamaño de la familia.. | Para los padres casados, el umbral de AGI se basa en 175% del nivel de pobreza federal de 2023, dado el tamaño de la familia.. |

CONSEJO: Su ingreso bruto ajustado se puede encontrar en su declaración de impuestos personal, 1040, línea 11.

Límites de ingresos de la FAFSA 2026-27

por estado civil y tamaño de la familia para los 48 estados inferiores.

| Tamaño de la familia | padre soltero con AGI 2024 + monto de exclusión de ingresos extranjeros igual o inferior | Padre casado con AGI 2024 + monto de exclusión de ingresos extranjeros igual o inferior |

|---|---|---|

| 2 | $45,990 | N / A |

| 3 | $58,095 | $45,185 |

| 4 | $70,200 | $54,600 |

| 5 | $82,305 | $64,015 |

| 6 | $94,410 | $73,430 |

| 7 | $106,515 | $82,845 |

| 8 | $118,620 | $92,260 |

| Para un padre soltero, el monto de exclusión de ingresos extranjeros + AGI El umbral se basa en 225% del nivel de pobreza federal de 2024, dado el tamaño de la familia. | Para padres casados, el monto de exclusión de ingresos extranjeros + AGI El umbral se basa en 175% del nivel de pobreza federal de 2024, dado el tamaño de la familia. |

SUGERENCIA: Su ingreso bruto ajustado se puede encontrar en su declaración de impuestos personal, 1040, línea 11 y el monto de exclusión de ingresos extranjeros se puede encontrar en el Anexo 1, línea 8d.

Límites de ingresos de la FAFSA 2027-28

por estado civil y tamaño de la familia para los 48 estados inferiores

| Tamaño de la familia | padre soltero con AGI 2025 + monto de exclusión de ingresos extranjeros igual o inferior | Padre casado con AGI 2025 + monto de exclusión de ingresos extranjeros igual o inferior |

|---|---|---|

| 2 | $47,588 | N / A |

| 3 | $59,963 | $46,638 |

| 4 | $72,338 | $56,263 |

| 5 | $84,713 | $65,888 |

| 6 | $97,088 | $75,313 |

| 7 | $109,463 | $85,138 |

| 8 | $121,838 | $94,763 |

| Para un padre soltero, el monto de exclusión de ingresos extranjeros + AGI El umbral se basa en 225% del nivel de pobreza federal de 2025, dado el tamaño de la familia. | Para padres casados, el monto de exclusión de ingresos extranjeros + AGI El umbral se basa en 175% del nivel de pobreza federal de 2025, dado el tamaño de la familia. |

SUGERENCIA: Su ingreso bruto ajustado se puede encontrar en su declaración de impuestos personal, 1040, línea 11 y el monto de exclusión de ingresos extranjeros se puede encontrar en el Anexo 1, línea 8d.

Límites de ingresos de la FAFSA 2028-29

por estado civil y tamaño de la familia para los 48 estados inferiores

| Tamaño de la familia | padre soltero con AGI 2026 + monto de exclusión de ingresos extranjeros igual o inferior | Padre casado con AGI 2026 + monto de exclusión de ingresos extranjeros igual o inferior |

|---|---|---|

| 2 | $48,690 | N / A |

| 3 | $61,470 | $47,810 |

| 4 | $74,250 | $57,750 |

| 5 | $87,030 | $67,690 |

| 6 | $99,810 | $77,630 |

| 7 | $112,613 | $87,588 |

| 8 | $125,370 | $97,510 |

| Para un padre soltero, el monto de exclusión de ingresos extranjeros + AGI El umbral se basa en 225% del nivel de pobreza federal de 2026, dado el tamaño de la familia. | Para padres casados, el monto de exclusión de ingresos extranjeros + AGI El umbral se basa en 175% del nivel de pobreza federal de 2026, dado el tamaño de la familia. |

SUGERENCIA: Su ingreso bruto ajustado se puede encontrar en su declaración de impuestos personal, 1040, línea 11 y el monto de exclusión de ingresos extranjeros se puede encontrar en el Anexo 1, línea 8d.

Cómo FAFSA y CSS Profile contabilizan los ingresos de los padres

Las reglas sobre qué ingreso de los padres se incluye al calcular el índice de ayuda estudiantil (o capacidad para pagar la universidad) difieren de las de FAFSA y CSS Profile.

FAFSA: una contabilidad más limitada de los ingresos

La FAFSA solo toma los ingresos de ciertas líneas de la declaración de impuestos personal de los padres. La declaración de impuestos personal para la FAFSA es el formulario 1040 e incluye los Anexos 1, 3 y C. Para obtener información detallada sobre los montos incluidos, consulte este enlace. recurso de la Ayuda Federal para Estudiantes con capturas de pantalla de la declaración de impuestos de 2023. En general, esto limita el total de ingresos incluidos.

Perfil CSS: una contabilidad más amplia de los ingresos

El Perfil CSS utiliza estos mismos ingresos como punto de partida, pero añade ingresos adicionales no tributables. El Perfil CSS exige que los padres presenten documentación adicional sobre sus ingresos, además del formulario 1040, incluyendo formularios W-2, 1099 y todas las declaraciones de impuestos comerciales. ¿Qué ingresos no tributables incluye el Perfil CSS? Estos pueden variar según las fuentes de ingresos y el tipo de empleo de los padres, por ejemplo, si trabajan para un empleador o por cuenta propia. Estos son los ejemplos más comunes:

- Contribuciones antes de impuestos a una cuenta de jubilación del empleador, como un 401k, 403b o pensión.

- Contribuciones antes de impuestos a una HSA.

- Para los propietarios de empresas, el IRS permite ciertas deducciones comerciales, pero no las considera gastos de salida exclusivamente para fines comerciales, como la deducción de la oficina en casa o el gasto comercial de un automóvil personal.

- Para los propietarios, el IRS permite la depreciación de la propiedad para compensar los ingresos por alquiler, pero el Perfil CSS no la permite para la elegibilidad de ayuda financiera.

En cada uno de estos casos, estos montos se suman a los ingresos tributables para calcular los ingresos utilizados en la evaluación de la ayuda financiera. Como resultado, se puede incluir una mayor cantidad de ingresos para evaluar la ayuda financiera basada en la necesidad a través del Perfil CSS que con la FAFSA.

Ingresos de los padres incluidos en el perfil FAFSA y CSS

Esta tabla resume los ingresos incluidos en cada solicitud.

| Ingreso | FAFSA | Perfil CSS |

|---|---|---|

| Ganancias del trabajo | Sí | Sí |

| Ganancias netas de las inversiones | Sí | Sí |

| Ganancias del negocio | Solo las ganancias netas informadas en la declaración de impuestos personales después de todas las deducciones permitidas por el IRS | Incluye las ganancias netas declaradas en su declaración de impuestos personal y la adición de algunas deducciones permitidas por el IRS |

| Ganancias provenientes de propiedades en alquiler | Sólo las ganancias netas informadas en su declaración personal después de todas las deducciones permitidas por el IRS. | Incluye las ganancias netas informadas en su declaración de impuestos personal y la adición de algunas deducciones permitidas por el IRS, como la depreciación. |

| Distribuciones de jubilación | Distribuciones de jubilación gravadas y no gravadas informadas en el formulario 1040, líneas 4a/4b y líneas 5a/5b | Distribuciones de jubilación gravadas y no gravadas informadas en el formulario 1040, líneas 4a/4b y líneas 5a/5b |

| Beneficios del Seguro Social | Solo los beneficios del Seguro Social gravados informados en el formulario 1040, línea 6b | Los beneficios del Seguro Social gravados y no gravados se declaran en el formulario 1040, línea 6a |

| Desempleo | Sí | Sí |

| Aportaciones antes de impuestos a cuentas de jubilación de autónomos (SEP, SIMPLE, etc…) | Sí, informado en el Anexo 1, línea 16 | Sí, informado en el Anexo 1, línea 16 |

| Contribuciones antes de impuestos a una cuenta IRA tradicional | Sí, informado en el Anexo 1, línea 20 | Sí, informado en el Anexo 1, línea 20 |

| Manutención infantil | Autodeclarado como activo principal, para un tratamiento más favorable | Sí, auto-reportado |

| Pagos por discapacidad | No | Sí, auto-reportado |

| Contribuciones antes de impuestos a las cuentas de jubilación del empleador (401k, 403b, etc.) | No | Sí, del W-2, casilla 12 |

| Contribuciones antes de impuestos a una HSA | No | Sí, declaración de impuestos o W-2 |

| Pensión alimenticia no gravada | No | Sí, auto-reportado |

| Ingresos comerciales adicionales compensados por ciertas deducciones del IRS | No | Sí, como se encuentra en la declaración de impuestos comerciales correspondiente |

| Ingresos de alquiler adicionales compensados por ciertas deducciones del IRS | No | Sí, como se encuentra en el Anexo E o la declaración correspondiente donde se incluye la propiedad. |

Cómo FAFSA y el Perfil CSS cuentan los activos de los padres

Las reglas para contabilizar los bienes de los padres al calcular el Índice de Ayuda Estudiantil (o su capacidad para pagar la universidad) difieren de las de la FAFSA y el Perfil CSS. Si bien comparten bienes, hay excepciones. Esta tabla resume qué bienes de los padres se contabilizan y cuáles están protegidos.

Bienes de los padres contabilizados y protegidos por FAFSA y el perfil CSS

| Activo principal | FAFSA | Perfil CSS |

|---|---|---|

| De cheques | Contado | Contado |

| Ahorros | Contado | Contado |

| CD (Certificados de Depósito) | Contado | Contado |

| Corretaje Cuentas | Contado | Contado |

| Rentas vitalicias no jubilatorias | Contado | Contado |

| Fideicomisos | Contado | Contado |

| Planes 529 y de ahorro para la universidad | Solo planes propiedad de los padres que beneficien al estudiante solicitante | Todos los planes propiedad de los padres, incluidos aquellos que benefician a otros hijos |

| Valor patrimonial de las segundas propiedades | Contado | Contado |

| Valor patrimonial de la vivienda principal | Protegido | Varía según el perfil CSS de la universidad; consulte esto recurso |

| Patrimonio neto de la empresa o granja | Si la empresa o finca emplea a 100 o menos empleados a tiempo completo, el patrimonio neto no se contabiliza. Para aquellos con más de 100 empleados a tiempo completo, el patrimonio neto ajustado se calcula antes de incluirlo como activo principal; consulte esto. recurso | Se contabilizan las empresas y granjas de cualquier tamaño. Sin embargo, el patrimonio neto ajustado se calcula antes de incluirlo como activo principal; consulte esto recurso |

| Cuentas de jubilación, por ejemplo, 401k, 403b, IRA, pensiones, etc. | Protegido | Protegido |

| Anualidades calificadas | Protegido | Protegido |

| Cuentas de ahorro para la salud (HSA) | Protegido | Protegido |

| Seguro de vida | Protegido | Protegido |

| Cuentas ABLE | Protegido | Protegido |

El impacto de los activos de los padres en el índice de ayuda estudiantil

Al contabilizar un activo, el monto declarado contribuye aproximadamente con 5% a su Índice de Ayuda Estudiantil. Los Activos Protegidos no tienen ningún impacto en su Índice de Ayuda Estudiantil. Ningún activo contabilizado tiene mayor ponderación que otro, como un Plan 529 o un Plan de Ahorro para la Universidad. Los Planes de Ahorro para la Universidad también contribuyen con 5%.

Ejemplo 1

Activos de los padres informados en la FAFSA:

| Activo | cantidad |

|---|---|

| Cuenta corriente para padres | $2,500 |

| Cuenta de ahorros para padres | $4,000 |

| Plan 529 para estudiantes propiedad de los padres | $39,000 |

| Patrimonio de los padres en la segunda propiedad | $150,000 |

| Activos totales de la matriz | $195,500 |

Contribución a SAI de los activos de la matriz = Activos totales de la matriz x 5%

Contribución a SAI de los activos de la matriz = $195.000 x 5% = $9.775

Ejemplo 2

Activos principales reportados en el Perfil CSS:

| Activo | cantidad |

|---|---|

| Cuenta corriente para padres | $4,500 |

| Cuenta de ahorros para padres | $40,000 |

| Planes 529 para dos hijos propiedad de los padres | $80,000 |

| Cuenta de corretaje | $27,000 |

| Activos totales de la matriz | $195,500 |

Contribución a SAI de los activos de la matriz = Activos totales de la matriz x 5%

Contribución a SAI de los activos de la matriz = $151,500 x 5% = $7,595