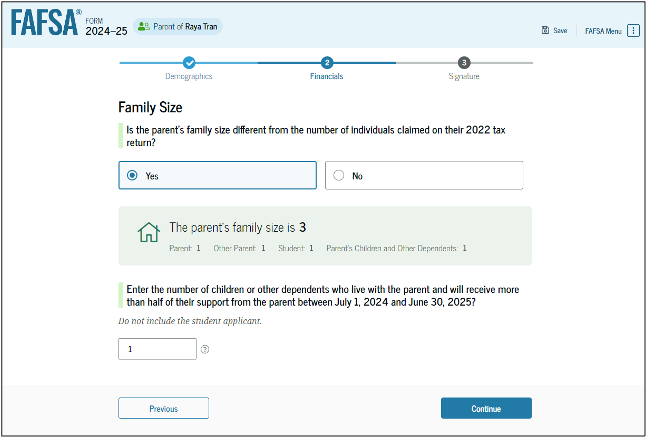

The family size, previously known as household size, will now be determined by the number of dependents claimed on the parent’s 2022 tax return. This number is part of the Federal Tax Information (FTI) shared by the IRS, so it will not be shown to the contributor on their application. The contributor can manually enter their own number in family to override that number shared by the IRS.

Does FAFSA want the number in family at the time of application or in 2022?

The number in family includes dependents living in the household that receive at least 50% of their support from the parent and will continue to receive at least 50% of support from the parent in the coming academic year (2024-25) when the student is in college. This can include non-children dependents like relatives and children who don’t live in the household because they are also attending college.

If the number isn’t shown, how does the parent know if it’s correct?

The parent can look at their 2022 tax return to total the number in family received from the IRS. The total is the parent or parents filing the return plus the number of dependents listed in the “Dependents” section on 1040, page 1.

Can the parent manually enter the number in family to be safe?

Many college access professionals suggest manual entry because of the many cases that there can be differences between the tax return and the actual number.

If the parent overrides the number in family from what is transferred, will this trigger a verification?

The Department of Education has stated that their standard verification will still be statistically driven, not driven by a manual entry of the number in college. This will not be considered “conflicting information” that a Financial Aid Administrator would be required to verify.