The rules and requirements for single, separated or divorced parents differ depending on the financial aid application. The information below clarifies the rules for both FAFSA (Free Application for Federal Student Aid) and the CSS Profile.

Comparison of FAFSA and CSS Profile rules for single, separated and divorced parents

This at-a-glance comparison links to more detailed explanations for each application below.

| Which parent should complete the application? | Only one parent submits information. | Both parents submit information. |

| Which parent should complete the application? | The parent who provided the greater financial support for the 12 months prior to sumbitting the FAFSA. If both parents contribute equally, then the parent with the higher income or assets. | The parent who completes the FAFSA submits the primary CSS Profile application with the student. The other parent will be invited to complete their form separately and confidentially. |

| How do we verify that one parent provided greater financial support? | FAFSA has no verification. FAFSA provides no definition or measure of what constitutes greater financial support. | CSS Profile follows same rules as FAFSA regarding what constituts greater financial support. |

| What if the other parent refuses to complete the financial aid applications? | FAFSA never requires the other parent’s information, so there is no impact. | CSS Profile colleges require both parents’ information for the student to be eligible for institutional need-based financial aid. If one parent refuses, the student will not be eligible. |

| What if the other parent does not have contact or provide financial support? | FAFSA never requires the other parent’s information, so there is no impact. | Students can ask each college to waive the requirement for the other parents’ information. A parent’s refusal to participate or pay for college is not sufficient reason for the waiver. |

Rules for 2026-27 FAFSA

Which parent completes the FAFSA?

If the student’s parents are 1. Never married, 2. Separated or 3. Divorced, and no longer live in the same household, only one parent – typically called the custodial parent – submits information on the FAFSA. However, if parents are living under the same roof, both parents will be required to submit their information regardless of marital status.

Who is the custodial parent?

The criteria FAFSA uses to determine who is the custodial parent are as follows:

- The parent who provides the greater financial support to the student in the 12 months prior to application submission.

- If the student receives equal support from both parents for that time period, then it’s the parent with the greater income or assets.

There is no basis for a parent to be the custodial parent for purposes of completing the FAFSA based on the following:

- Which parent the student lives with the most.

- Which parent has legal custody.

- Which parent claims the student on their taxes.

The custodial parent needs to create a Federal Student Aid (FSA) ID to complete and electronically sign the student’s FAFSA. Watch this short video tutorial on how to create an FSA ID.

What if the custodial parent is remarried?

A custodial parent who is remarried reports income and asset information for both themself and their spouse. This is true even if the new spouse has not adopted the student. FAFSA requires the entire household’s financial information for financial aid consideration.

Rules for the 2026-27 CSS Profile

Which parent completes the CSS Profile?

Most CSS Profile colleges will require both biological parents to submit their information, even if the parents are 1. Never married, 2. Separated, or 3. Divorced. Both the custodial parent and the noncustodial parent submit their information separately and securely into a single student application that the colleges receive. Information submitted by each biological parent is never shared with the other parent.

Who is the custodial parent?

CSS Profile follows the same criteria as FAFSA in determining the custodial parent. The custodial parent submits their information in the primary application submitted by the student. This application can be completed using the student’s College Board login, or the custodial parent can create their own College Board login. In the primary application, the student identifies their other parent, known as the noncustodial parent, and invites that parent to contribute to their CSS Profile.

How does the noncustodial parent submit her/his information?

The noncustodial parent creates a College Board login to submit her/his information. The parent links the information that they are submitting by using the CSS Profile Financial Aid ID, aka “CBFinAid ID,” associated with the student’s primary application. This ensures that the information is combined into a single application for the college. No access to this information is granted to either the student or the custodial parent.

What if either parent is remarried?

If either parent is remarried, the remarried parent reports financial information for themself and their spouse. This is true even if the new spouse has not adopted the student. The CSS Profile requires the entire household’s financial information.

What if the noncustodial parent cannot or will not submit their information?

CSS Profile colleges do not consider a parent’s unwillingness to participate and submit their information as sufficient reason not to collect this information. Non-submission by either parent prevents a college from processing the student’s financial aid application for institutional need-based aid.

Colleges provide a formal waiver process for a student to petition for the noncustodial parent information to be omitted or waived. The waiver must be submitted separately to each college’s financial aid office, and each college uses its own evaluation process and discretion in granting a waiver.

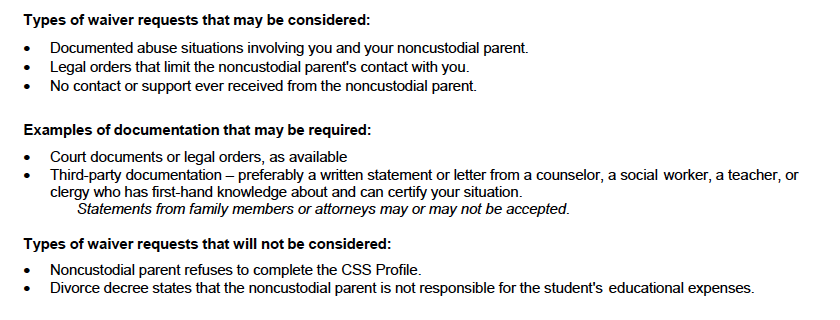

The standard waiver request form clearly states circumstances that will and will not be considered for the waiver, often requiring “no contact” with the noncustodial parent. However, each college creates its own criteria for which circumstances to consider. Colleges may also require documentation to support your waiver.

You can review the entire standard waiver request form using the link below. Remember to check with your specific college’s financial aid office, as they may have created their own institutional waiver request form.

Resource center for divorced or separated parents on the CSS Profile website

The CSS Profile Info for Divorced or Separated Parents resource center includes several resources, including: