A step-by-step checklist

If your student’s financial aid award doesn’t reflect your family’s true financial picture, you can appeal. An appeal for professional judgment is a standard part of the financial aid process. Appeal funds can be limited, so the sooner you submit a complete, well-documented appeal, the better your chances for a re-award.

Step 1: Research the College’s Appeal Process

Each college handles appeals differently. Understanding their specific process before you start will save time and prevent your appeal from being delayed or rejected on a technicality.

- Go to the college’s financial aid website and search for their appeals section

- Search for terms like “special circumstances,” “professional judgment,” or “financial aid appeal” along with the school’s name

- Note whether they require a specific form, an online portal submission, or a letter

- Review what circumstances they normally consider — and what they won’t consider

- Note any deadlines or documentation requirements

Many colleges now clearly list the circumstances they will and will not consider on their website. This helps you focus your appeal on what matters most to that specific school.

Step 2: Identify and Organize Your Special Circumstances

If your circumstance isn’t listed on the college’s website, you can still submit an appeal with an explanation of how it affects your household finances and ability to pay for college. Focus on circumstances beyond your control, not discretionary lifestyle choices.

Organize your appeal into categories:

1. Changes in income: job loss, salary reduction, retirement, end of child support or Social Security benefits, volatile or seasonal income, or any shift that makes your current income look different from what your tax return shows.

2. Extraordinary or burdensome expenses: unreimbursed medical and dental costs, care for a special-needs or elderly family member, private K-12 tuition for siblings, disability-related expenses, high legal fees, or home repairs or loss.

- List each special circumstance that applies to your family

- For each one, write down the specific dollar amounts and financial impact

- Break down large categories — for example, separate medical expenses into insurance premiums, prescriptions, procedures, and out-of-pocket costs

Step 3: Write Your Appeal Letter

Keep it to one or two pages. Be specific, be factual, and be polite. The financial aid office is essentially the final decision-maker.

- Open with gratitude for the existing award and your student’s interest in the college

- Summarize each special circumstance with dates and dollar amounts

- Explain the financial impact on your family’s ability to pay

- Do not request a specific dollar amount — let the financial aid office determine the adjustment

- Close by thanking the administrator for their consideration

Address your letter to a specific person whenever possible. Call the financial aid office or check the website for the name of the director or the person who handles appeals.

Step 4: Gather and Attach Documentation

Independent, third-party documentation strengthens your appeal and may be required. Financial aid offices need objective evidence to justify increasing your award.

- Gather documents for every circumstance you reference in your letter

- Examples include layoff or termination notices, medical and dental bills, bank account statements, receipts, tax returns, and W-2 forms

- Always send copies — never originals

- Label each document clearly with your student’s name

Step 5: Run the Net Price Calculator

The Net Price Calculator (NPC) on the college’s website lets you estimate what your award might look like if your appeal is accepted. Enter your updated financial information to see the potential difference.

- Run the NPC with the financial information you submitted on your FAFSA or CSS Profile

- Re-run it with the new financial information you are submitting in the appeal

- Compare the estimated result with your current award

- Use these results in your appeal, but more importantly, use them to compare potential revised awards across colleges

Step 6: Submit to Every College and Follow Up

Send your appeal to each college where you’d like a review — not just your top choice. Then confirm receipt and stay engaged.

- Submit your letter, documentation, and any required forms to each college

- Follow the submission method each college requires (portal, email, or mail)

- Call the financial aid office about one week after submitting to confirm receipt

- Ask if they need any additional information to complete the review

Appeals can be submitted at any time — even mid-year — and it’s worth resubmitting each academic year if your circumstances continue.

2026-27 FAFSA Student Aid Index (SAI) Calculator

What is the Student Aid Index?

The 2026-27 FAFSA, or Free Application for Federal Student Aid, is the primary application for need-based financial aid for the 2026-27 academic year. A student and one or more parents submit household and financial information. Based on this information, the FAFSA calculates the amount a family can pay for college in a given year, called the Student Aid Index (SAI).

A college’s financial aid office uses the Student Aid Index in the simple equation below to determine a student’s eligibility for need-based financial aid, given the college’s Cost of Attendance.

Cost of Attendance

– Student Aid Index (SAI)

_____________________________

= Financial Need

A student’s Financial Need is their eligibility for aid at a college. However, each college’s policies on allocating their institutional need-based funds determine the financial aid offer a student will ultimately receive, which may or may not meet a student’s calculated Financial Need. Read more

How is the Student Aid Index calculated?

Family size, parents’ marital status, state of residence, along with four primary financial inputs, determine the 2026-27 Student Aid Index.

- Parent 2024 Income

- Parent Assets on date of filing

- Student 2024 Income

- Student Assets on date of filing

One significant change is the number of students in college will no longer be used in the SAI formula.

1) Parent Income

The 2026-27 FAFSA relies on 2024 federal tax returns for all parent income, eliminating the reporting of non-taxed income not included on the federal tax returns. Pre-tax contributions to employer-sponsored retirement plans – 401k, 403b, Pension, etc… – no longer count as part of parent income.

If the parent is not required to file federal tax returns in 2024, then the SAI = -$1,500. This step is incorporated as part of this calculator. Read more

2) Parent Assets

The 2026-27 FAFSA counts the following assets as part of a parent’s net worth available to pay for college:

- Checking

- Savings/Money Market Accounts

- CDs

- Brokerage accounts

- 529 or college savings plans only for the student applicant

- Equity value of second properties.

Two additional categories can be counted as parent assets for the calculation of SAI.

- Child support received.

A parent reports all child support received in the calendar year before filing the FAFSA as an asset. - Net worth of business or farm.

If a parent owns a business or farm that employs more than 100 full-time employees, then the net worth is reported on the FAFSA. The net worth is the value of the business or farm minus any debt against that business or farm. A parent who is only a part owner would report their percentage of the overall net worth.

Protected assets are not counted on the FAFSA:

- Retirement Accounts – 401k, 403b, IRAs, Pensions, etc…

- Life insurance

- Primary home

The contribution rate from the total net worth of parent assets reported is roughly 5%.

3) Student Income

The 2026-27 FAFSA provides income protection for a student equal to $11,770. So, there is no expected contribution from student income if 2024 income is $11,770 or less. For every dollar over this amount, the contribution rate is 50%.

4) Student Assets

All assets held by a student outside of retirement are reported. These include checking, savings, CDs, and brokerage accounts. 529 or college savings plans owned by the student are always reported as a parent asset. The contribution rate for student assets is 20% of every dollar.

2026-27 FAFSA Student Aid Index Calculator

To calculate your Student Aid Index, use values from the parent’s and student’s 2024 tax returns and the current value of parent and student assets. Note: This calculator is for dependent students.

How was this calculator developed?

This calculator follows the updated 2026-27 Student Aid Index formula published by the Department of Education in August 2025. You can download the formula sheet here.

What does a negative SAI mean?

The Student Aid Index can now be as low as -$1,500. To determine a student’s eligibility (Cost of Attendance – SAI = Financial Need/Eligibility), colleges will set the SAI to equal $0. However, the college may consider a negative SAI in evaluating college-based programs for high-need students.

Demonstrated need and colleges’ financial aid policies: a calculator

What is Demonstrated Need?

Your Demonstrated Need is the amount of need-based financial aid you may be eligible for. Every college determines your Demonstrated Need, or financial aid eligibility, using this fundamental equation:

Cost of Attendance

– Student Aid Index (ability to pay determined by FAFSA or CSS Profile)

_____________________________

= Demonstrated Need or Eligibility for Need-based Aid

Colleges that only require FAFSA use the FAFSA Student Aid Index (SAI) to measure a family’s ability to pay and determine a student’s eligibility for institutional need-based aid. Colleges that require the CSS Profile calculate a custom Student Aid Index (SAI) to measure a family’s ability to pay and determine the student’s eligibility for institutional need-based aid.

How to know your Student Aid Index?

You can calculate your FAFSA Student Aid Index using the College Money Method SAI Calculator. For the CSS Profile, there is no overall Profile SAI calculator, since each college can customize the inputs and formulas. To explore CSS Profile eligibility, it’s best to use the Net Price Calculator for each CSS Profile college.

What is the Percent of Need Met?

While you may have a certain amount of Demonstrated Need at a college, this doesn’t mean that you will receive a financial aid package to equal that need. Many colleges don’t have the ability to provide a financial aid package that can meet a student’s full need (Read more here). Luckily, colleges publish data on a yearly basis on what percent of need they meet on average. Given this information, you can know ahead of time how generous a college is with their need-based financial aid offers.

Demonstrated Need

x Percent of Need Met

_____________________________

= Anticipated Financial Aid Offer

Let’s take an example. Chapman University meets 75% of demonstrated need on average. If your FAFSA SAI is equal to $22,000, given their cost of attendance of $87,730, your demonstrated need is equal to $40,700 ($87,730 – $22,000). However, because, on average, Butler offers a financial aid package that meets 70% of that need, you should expect a financial aid offer of about $28,500 (70% of $40,700). This leaves you with a gap in the financial aid offer of $12,200, which is an additional out-of-pocket cost beyond your Student Aid Index of $22,000.

The Demonstrated Need Calculator

It’s essential to understand which colleges “gap” your financial aid, and by how much, so that you can plan for these additional costs. You can use this calculator to explore FAFSA colleges’ financial aid policies and their impact on your expected ability to pay.

Changes to Parent PLUS borrowing

What is the Parent PLUS Loan?

The Parent PLUS Loan is offered by the Department of Education to parents borrowing for a student’s undergraduate education.

The qualification threshold for the Parent PLUS Loan is lower than for private loans. Private loans offers are based on a borrower’s credit score or debt-to-income ratio. Parent PLUS Loans only require that the borrower not have an adverse credit history, such as a bankruptcy in the last 7 years or a 90-day default on current debt.

For more information about the Parent PLUS Loan, including current interest rates, check out the Department of Education’s resources.

What’s changing?

Borrowing limits have new caps, repayment plan is limited to the Standard Repayment option and Parent PLUS Loan will no longer qualify for federal loan forgiveness programs.

| Award Year 2026-27 and beyond | |

| Borrowing Limits | Parent PLUS Loans are capped at $20,000 per year, $65,000 total for a student’s undergraduate education. |

| Repayment Plans | Parent PLUS Loans must remain on the Standard Repayment option. Parent PLUS loans are no longer eligible for Income-based Repayment plans. |

| Loan Forgiveness | Parent PLUS Loans are no longer eligible for any federal loan forgiveness, including Public Service Loan Forgiveness (PSFL). |

When do changes take place?

On July 1, 2026, these changes will impact Parent PLUS loans for Award Year 2026-27 and beyond. Parents borrowing for the first time after this date will be subject to these new terms. Parent PLUS Loans disbursed before July 1, 2026 remain subject to the current terms.

Merit-based Aid Data

Building affordability with college merit aid

When a student isn’t eligible for need-based financial aid, merit scholarships awarded by a college can be a significant way to reduce costs and build affordability. Merit scholarships are awarded primarily through the admissions process as an incentive for students to enroll, with no criteria around need.

How to measure a college’s merit generosity

There are two ways to understand a college’s generosity with merit aid: 1) the number of students receiving merit scholarships and 2) the size of these awards.

The number of awards

Colleges vary widely in how many merit scholarships they give out, with colleges that offer no merit scholarships on one end and colleges that award every admit a merit discount.

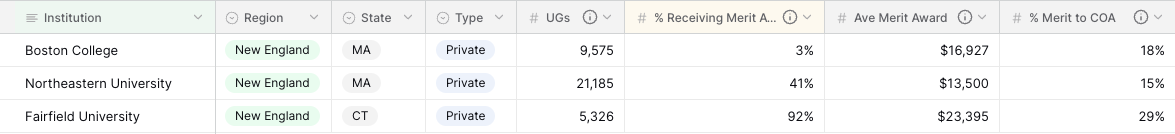

The DATA: Colleges publish the percentage of students who do not qualify for need-based aid and still receive a merit scholarship. This can be found in the column % Receiving Merit Awards.

A student seeking merit aid can understand that the chances of receiving a scholarship from Boston College (3%) are highly unlikely, from Northeastern (41%) are possible, and from Fairfield (92%) are certainly guaranteed.

The size of the award

It’s critical to understand the amount of the scholarship that a college may offer to ensure that it’s enough to make the Net Price affordable.

THE DATA: Colleges publish the average merit scholarship received by non-need students. This can be found in the column Ave Merit Award. It’s also helpful to understand what percentage of the cost of attendance the average merit scholarship covers. This can be found in the column % Merit to COA.

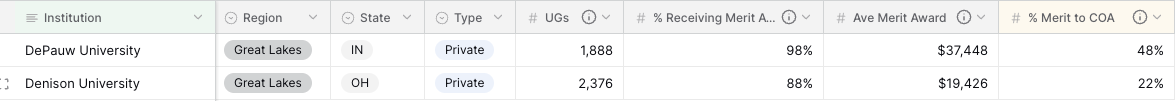

While a student admitted to both DePauw and Denison would reliably receive a merit scholarship in the admissions process, there is a significant difference in the award amount. DePauw’s average scholarship of $37,448 covers nearly 50% of the cost of attendance, whereas Denison’s average scholarship of $19,426 covers just above 20%.

College Data from the 2024-25 Common Data Set

Use this online database to explore colleges’ generosity with merit-based aid.

Tips:

- FILTER: When using the Filter for Region or State column, choose the is any of option to select multiple Regions or States.

- INFO ICON: The info icon next to the column name provides a more detailed description of the data presented.

- DOWNLOAD: To download a copy, click on the 3 dots and select Export to CSV. It will save the file with any changes you’ve made. Note: I don’t recommend downloading to Excel, because it will convert the number fields, like percents and dollars, to text fields.

Need-based Financial Aid Data

Not every college can meet your student’s need.

In fact, only 70 out of the 460+ colleges on the list below meet 100% of need or aid eligibility.

Why do colleges gap financial aid?

There are two key reasons why a college’s financial aid offer may not match or equal your student’s aid eligibility.

Most colleges don’t have enough resources.

Most colleges provide an award that is only a percentage of the student’s eligibility, resulting in a gap in the financial aid offer.

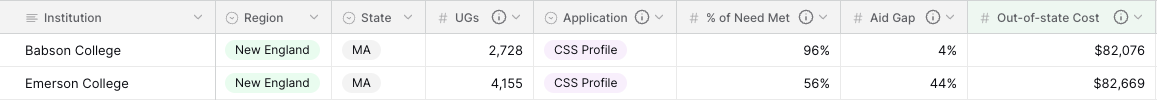

The DATA: Colleges publish the percentage of need or eligibility they meet on average, which can be found in the data below in the column % of Need Met.

If a student were eligible for $30,000 in need-based financial aid at both Babson and Emerson, the student would expect to receive nearly $30,000 from Babson (at 96%), but only about $15,000 from Emerson (at 56%).

Public universities only fund their resident students.

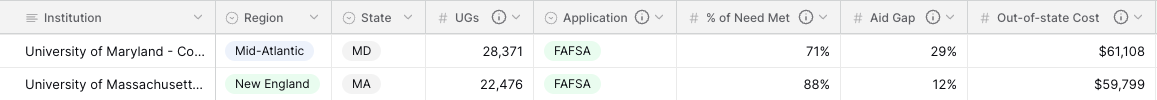

Public universities only award institutional need-based financial aid to their in-state, resident students. Out-of-state students admitted should expect to receive no institutional need-based aid, resulting in a huge aid gap.

THE DATA: You should assume 0 % of Need Met, except for federal aid options. The numbers reported for public universities below reflect the percentage of need met for their in-state, resident students

A student from Maryland admitted to U Mass Amherst would not have 88% of their need met. They would pay full Out-of-state Cost at nearly $60,000, except for any merit scholarships or federal aid.

College Data from the 2024-25 Common Data Set

Use this online database to explore colleges’ generosity with need-based financial aid.

Tips:

- FILTER: When using the Filter for Region or State column, choose the is any of option to select multiple Regions or States.

- INFO ICON: The info icon next to the column name provides a more detailed description of the data presented.

- DOWNLOAD: To download a copy, click on the 3 dots and select Export to CSV. It will save the file with any changes you’ve made. Note: I don’t recommend downloading to Excel, because it will convert the number fields, like percents and dollars, to text fields.

Financial Aid Support for Families Impacted by the Southern California Fires

These resources are offered to support families with college-bound students in the Los Angeles area affected by the January 2025 wildfires. College financial aid offices want to understand changes in your financial circumstances as a result of this natural disaster to comprehensively evaluate your financial need and award need-based aid.

Through a financial aid appeal, you can submit new information about the financial impact of this event to supplement and amend the information submitted on the FAFSA or CSS Profile. Through a process known as Professional Judgment, the college financial aid office will include new factors like reduction in income, extraordinary expenses, and loss of assets in their evaluation or re-evaluation of your financial aid eligibility and award.

It’s important to advocate for these changes and engage in this process early. Start with these resources and work with your college counselor for support. Reach out to the financial aid offices; they are there to help.

Workshop Recording

This workshop was recorded on February 18, 2025, in partnership with LAISCC schools.

Financial Aid Appeal Letter Template

Use this appeal letter as a template for requesting an adjustment to financial aid. Edit language to best reflect your personal circumstances. The italicized sections are prompts for writing.

Q&A

These are the questions asked by families during our workshop, along with answers and guidance provided.

Income limits to receive the Pell Grant

How is Pell Grant eligbility determined?

Maximum Pell Grant

The FAFSA determines whether the student qualifies for the Maximum Pell Grant based on two factors: 1) parents’ Adjusted Gross Income (AGI) plus Foreign Income Exclusion Amount in the base year, family size and state of residence, and 2) the student’s calculated Student Aid Index (SAI). When a parent’s AGI plus Foreign Income Exclusion Amount is at or below limits based on marital status and family size in the tables below, the student may qualify for the Maximum Pell Grant. The Maximum Pell Grant is determined annually by Congress, and the amount for the 2026-27 Award Year is expected to be $7,395.

Starting with 2026-27 FAFSA, all students will receive a calculated Student Aid Index (SAI). If the Student Aid Index (SAI) is more than twice the Maximum Pell Grant amount for 2026-27 – or $14,790 – then the student will not be eligible to receive the Pell Grant even though the parents’ AGI plus Foreign Income Exclusion Amount is at or below the amount in the table below.

Partial Pell Grant

A student can still receive a partial Pell Grant when their parents’ AGI plus Foreign Income Exclusion Amount exceeds the limits below. This partial Pell Grant is calculated based on the Student Aid Index (SAI). When the SAI is less than the Maximum Pell Grant, the student may be awarded the difference between the two.

Maximum Pell Grant Income Limits

This table provides the parent income limits for a dependent student for the three FAFSA cycles: 2025-26 FAFSA, 2026-2027 FAFSA, and 2027-28 FAFSA.

2025-26 FAFSA Income Limits

by marital status and family size for the lower 48 states

| Family size | unmarried parent with 2023 AGI at or below | Married parent with 2023 AGI at or below |

|---|---|---|

| 2 | $44,370 | N/A |

| 3 | $55,935 | $43,505 |

| 4 | $67,500 | $52,500 |

| 5 | $79,065 | $61,495 |

| 6 | $90,630 | $70,490 |

| 7 | $102,195 | $79,485 |

| 8 | $113,760 | $88,480 |

| For an unmarried parent, the AGI threshold is based on 225% of the 2023 federal poverty level, given family size. | For married parents, the AGI threshold is based on 175% of the 2023 federal poverty level, given family size. |

TIP: Your Adjusted Gross Income can be found on your personal tax return, 1040, line 11.

2026-27 FAFSA Income Limits

by marital status and family size for the lower 48 states.

| Family size | unmarried parent with 2024 AGI + foreign Income Exclusion amount at or below | Married parent with 2024 AGI + foreign Income Exclusion amount at or below |

|---|---|---|

| 2 | $45,990 | N/A |

| 3 | $58,095 | $45,185 |

| 4 | $70,200 | $54,600 |

| 5 | $82,305 | $64,015 |

| 6 | $94,410 | $73,430 |

| 7 | $106,515 | $82,845 |

| 8 | $118,620 | $92,260 |

| For an unmarried parent, the AGI + Foreign Income Exclusion Amount threshold is based on 225% of the 2024 federal poverty level, given family size. | For married parents, the AGI + Foreign Income Exclusion Amount threshold is based on 175% of the 2024 federal poverty level, given family size. |

TIP: Your Adjusted Gross Income can be found on your personal tax return, 1040, line 11 and Foreign Income Exclusion Amount can be found on Schedule 1, Line 8d.

2027-28 FAFSA Income Limits

by marital status and family size for the lower 48 states

| Family size | unmarried parent with 2025 AGI + foreign Income Exclusion amount at or below | Married parent with 2025 AGI + foreign Income Exclusion amount at or below |

|---|---|---|

| 2 | $47,588 | N/A |

| 3 | $59,963 | $46,638 |

| 4 | $72,338 | $56,263 |

| 5 | $84,713 | $65,888 |

| 6 | $97,088 | $75,313 |

| 7 | $109,463 | $85,138 |

| 8 | $121,838 | $94,763 |

| For an unmarried parent, the AGI + Foreign Income Exclusion Amount threshold is based on 225% of the 2025 federal poverty level, given family size. | For married parents, the AGI + Foreign Income Exclusion Amount threshold is based on 175% of the 2025 federal poverty level, given family size. |

TIP: Your Adjusted Gross Income can be found on your personal tax return, 1040, line 11 and Foreign Income Exclusion Amount can be found on Schedule 1, Line 8d.

2028-29 FAFSA Income Limits

by marital status and family size for the lower 48 states

| Family size | unmarried parent with 2026 AGI + foreign Income Exclusion amount at or below | Married parent with 2026 AGI + foreign Income Exclusion amount at or below |

|---|---|---|

| 2 | $48,690 | N/A |

| 3 | $61,470 | $47,810 |

| 4 | $74,250 | $57,750 |

| 5 | $87,030 | $67,690 |

| 6 | $99,810 | $77,630 |

| 7 | $112,613 | $87,588 |

| 8 | $125,370 | $97,510 |

| For an unmarried parent, the AGI + Foreign Income Exclusion Amount threshold is based on 225% of the 2026 federal poverty level, given family size. | For married parents, the AGI + Foreign Income Exclusion Amount threshold is based on 175% of the 2026 federal poverty level, given family size. |

TIP: Your Adjusted Gross Income can be found on your personal tax return, 1040, line 11 and Foreign Income Exclusion Amount can be found on Schedule 1, Line 8d.

How FAFSA versus CSS Profile count parent income

The rules on what Parent Income is included when calculating your Student Aid Index – or ability to pay for college – differ from FAFSA and CSS Profile.

FAFSA : a more limited accounting of income

The FAFSA only takes income from certain lines of a parent’s personal tax return. The personal tax return for FAFSA purposes is the 1040 and includes Schedule 1, Schedule 3, and Schedule C. For a detailed look at which amounts are included, check out this resource from Federal Student Aid with screenshots from the 2023 tax return. Overall, this limits the total income included.

CSS Profile : a broader accounting of income

The CSS Profile uses this same income as a starting point but adds additional untaxed income. The CSS Profile requires parents to submit additional income documents beyond the 1040, including W-2s, 1099s, and all business tax returns. What is the untaxed income that the CSS Profile includes? They can vary depending on a parent’s sources of income and form of employment, e.g. working for an employer or self-employed. Here are the most common examples:

- Pre-tax contributions to an employer retirement account, like a 401k, 403b, or pension.

- Pre-tax contributions to an HSA.

- For business owners, certain business deductions are allowed by the IRS but not considered outgoing expenses exclusively for business purposes, like the home office deduction or business expense of a personal car.

- For property owners, depreciation of the property is allowed by the IRS to offset rental income but is not allowed by CSS Profile for financial aid eligibility.

In each of these cases, these amounts are added back to the taxable income to calculate the income used in the financial aid evaluation. The result can be that a larger amount of income is included for evaluating need-based financial aid through the CSS Profile versus the FAFSA.

Parent Income Included in the FAFSA and CSS Profile

This table summarizes the income included in each application.

| Income | FAFSA | CSS Profile |

|---|---|---|

| Earnings from work | Yes | Yes |

| Net earnings from investments | Yes | Yes |

| Earnings from business | Only net earnings reported on the personal tax return after all IRS-allowable deductions | Includes net earnings reported on your personal tax return and the addition of some IRS-allowable deductions |

| Earnings from rental properties | Only net earnings reported on your personal return after all IRS allowable deductions. | Includes net earnings reported on your personal tax return and the addition of some IRS-allowable deductions, like depreciation |

| Retirement distributions | Both taxed and untaxed retirement distributions reported on 1040, lines 4a/4b & lines 5a/5b | Both taxed and untaxed retirement distributions reported on 1040, lines 4a/4b & lines 5a/5b |

| Social Security benefits | Only taxed Social Security benefits reported on 1040, line 6b | Both taxed and untaxed Social Security benefits reported on 1040, line 6a |

| Unemployment | Yes | Yes |

| Pre-tax contributions to self-employed retirement accounts (SEP, SIMPLE, etc…) | Yes, reported on Schedule 1, line 16 | Yes, reported on Schedule 1, line 16 |

| Pre-tax contributions to traditional IRA | Yes, reported on Schedule 1, line 20 | Yes, reported on Schedule 1, line 20 |

| Child support | Self-reported as a Parent Asset, for more favorable treatment | Yes, self-reported |

| Disability payments | No | Yes, self-reported |

| Pre-tax contributions to employer retirement accounts (401k, 403b, etc…) | No | Yes, from W-2, box 12 |

| Pre-tax contributions to an HSA | No | Yes, tax return or W-2 |

| Untaxed alimony | No | Yes, self-reported |

| Additional business income offset by certain IRS deductions | No | Yes, as found on applicable business tax return |

| Additional rental income offset by certain IRS deductions | No | Yes, as found on Schedule E or applicable return where the property is listed |

How FAFSA versus CSS Profile count parent assets

The rules for which Parent Assets are counted in calculating your Student Aid Index – or ability to pay for college – differ from FAFSA and CSS Profile. While there are assets in common, there are exceptions. This chart summarizes which Parent Assets are counted and which are protected.

Parent Assets Counted and Protected by FAFSA and CSS Profile

| Parent Asset | FAFSA | CSS Profile |

|---|---|---|

| Checking | Counted | Counted |

| Savings | Counted | Counted |

| CDs (Certificate of Deposits) | Counted | Counted |

| Brokerage Accounts | Counted | Counted |

| Non-retirement annuities | Counted | Counted |

| Trusts | Counted | Counted |

| 529 & College Savings Plans | Only Plans owned by parents that benefit the student applicant | All Plans owned by parents, including those that benefit other children |

| Equity Value of Second Properties | Counted | Counted |

| Equity Value of Primary Home | Protected | Varies by CSS Profile college; see this resource |

| Net worth of business or farm | If the business or farm employs 100 or fewer full-time employees, the net worth is not counted. For those with more than 100 full-time employees, adjusted net worth is calculated before including as a Parent Asset; see this resource | Businesses and farms of any size are counted. however, adjusted net worth is calculated before including as a Parent Asset; see this resource |

| Retirement accounts, e.g. 401k, 403b, IRAs, pensions, etc.. | Protected | Protected |

| Qualified annuities | Protected | Protected |

| Health Savings Accounts (HSAs) | Protected | Protected |

| Life Insurance | Protected | Protected |

| ABLE Accounts | Protected | Protected |

Impact of Parent Assets on the Student Aid Index

When an asset is counted, the reported amount contributes roughly 5% toward your Student Aid Index. Protected Assets have zero impact on your Student Aid Index. No counted asset is weighted more than another, like a 529 or College Savings Plan. College Savings Plans also contribute 5%.

Example 1

Parent assets reported on the FAFSA:

| Asset | amount |

|---|---|

| Parent Checking Account | $2,500 |

| Parent Savings Account | $4,000 |

| Student 529 Plan owned by Parent | $39,000 |

| Parent Equity in Second Property | $150,000 |

| Total Parent Assets | $195,500 |

Contribution to SAI from Parent Assets = Total Parent Assets x 5%

Contribution to SAI from Parent Assets = $195,000 x 5% = $9,775

Example 2

Parent assets reported on the CSS Profle:

| Asset | amount |

|---|---|

| Parent Checking Account | $4,500 |

| Parent Savings Account | $40,000 |

| 529 Plans for two children owned by Parent | $80,000 |

| Brokerage Account | $27,000 |

| Total Parent Assets | $195,500 |

Contribution to SAI from Parent Assets = Total Parent Assets x 5%

Contribution to SAI from Parent Assets = $151,500 x 5% = $7,595