The reported net worth of a business is not counted dollar-for-dollar as a parent asset available for college. Instead, both FAFSA and CSS Profile calculate an adjusted net worth for a business before including it as a parent asset. The same applies to farms.

How to calculate business net worth

The net worth of a business is calculated by taking tangible assets owned by the business and subtracting debt against those tangible assets. Examples of tangible assets would be:

- Property owned by the business

- Vehicle

- Equipment

- Value of sellable goods

- Cash in the business

More favorable treatment for business assets

This more favorable treatment means that when an asset is held by a business entity, it has a lesser impact on a student’s aid eligibility than when an asset is held directly by a parent. A common example is a rental property. When a rental property is titled to a business rather than a parent, its net worth can be reported as a business asset.

Here’s an example:

A rental property has equity or net worth = $350,000.

| Ownership by | Net worth | Net worth as parent asset | contribution to student aid index |

|---|---|---|---|

| Business | $350,000 | $158,000 | $7,900 |

| Parent | $350,000 | $350,000 | $17,500 |

| Difference | -$192,000 | -$9,600 |

Calculation for business assets

Here is the adjusted net worth calculation for the 2026-27 FAFSA (2026-27 CSS Profile also follows this calculation). You can enter the net worth of your business to understand what adjusted net worth would be used when calculating parent assets available for college. The financial aid applications will calculate a roughly 5% ability to pay from this adjusted net worth.

Paths to excluding parent assets from the FAFSA

Parent assets reported on the FAFSA impact a student’s aid eligibility. The amount parents are expected to contribute from assets reported can be as high as 5.64% per year, with a rough average of 5%. Given this, the ability to exclude assets from the calculation of the Student Aid Index can be helpful to maximize eligibility.

These are the three scenarios where a parent is exempt from reporting parent assets.

1) Student is eligible for the Maximum Pell Grant

The FAFSA determines whether the student qualifies for the Maximum Pell Grant based on a parent’s Adjusted Gross Income (AGI) in the base year, family size and state of residence. When the parent’s AGI is at or below the threshold based on marital status and family size, the student qualifies for the Maximum Pell Grant. In this case, neither student nor parent assets will be included in the calculation of the Student Aid Index. The student is assigned a Student Aid Index (SAI) equal to $0

2025-26 FAFSA Income Limits

by marital status and family size for the lower 48 states

| Family size | unmarried parent with 2023 AGI at or below | Married parent with 2023 AGI at or below |

|---|---|---|

| 2 | $44,370 | N/A |

| 3 | $55,935 | $43,505 |

| 4 | $67,500 | $52,500 |

| 5 | $79,065 | $61,495 |

| 6 | $90,630 | $70,490 |

| 7 | $102,195 | $79,485 |

| 8 | $113,760 | $88,480 |

| For an unmarried parent, the AGI threshold is based on 225% of the 2023 federal poverty level, given family size. | For married parents, the AGI threshold is based on 175% of the 2023 federal poverty level, given family size. |

TIP: Your Adjusted Gross Income can be found on your personal tax return, 1040, line 11.

2026-27 FAFSA Income Limits

by marital status and family size for the lower 48 states.

| Family size | unmarried parent with 2024 AGI + foreign Income Exclusion amount at or below | Married parent with 2024 AGI + foreign Income Exclusion amount at or below |

|---|---|---|

| 2 | $45,990 | N/A |

| 3 | $58,095 | $45,185 |

| 4 | $70,200 | $54,600 |

| 5 | $82,305 | $64,015 |

| 6 | $94,410 | $73,430 |

| 7 | $106,515 | $82,845 |

| 8 | $118,620 | $92,260 |

| For an unmarried parent, the AGI + Foreign Income Exclusion Amount threshold is based on 225% of the 2024 federal poverty level, given family size. | For married parents, the AGI + Foreign Income Exclusion Amount threshold is based on 175% of the 2024 federal poverty level, given family size. |

TIP: Your Adjusted Gross Income can be found on your personal tax return, 1040, line 11 and Foreign Income Exclusion Amount can be found on Schedule 1, Line 8d.

2027-28 FAFSA Income Limits

by marital status and family size for the lower 48 states

| Family size | unmarried parent with 2025 AGI + foreign Income Exclusion amount at or below | Married parent with 2025 AGI + foreign Income Exclusion amount at or below |

|---|---|---|

| 2 | $47,588 | N/A |

| 3 | $59,963 | $46,638 |

| 4 | $72,338 | $56,263 |

| 5 | $84,713 | $65,888 |

| 6 | $97,088 | $75,313 |

| 7 | $109,463 | $85,138 |

| 8 | $121,838 | $94,763 |

| For an unmarried parent, the AGI + Foreign Income Exclusion Amount threshold is based on 225% of the 2025 federal poverty level, given family size. | For married parents, the AGI + Foreign Income Exclusion Amount threshold is based on 175% of the 2025 federal poverty level, given family size. |

TIP: Your Adjusted Gross Income can be found on your personal tax return, 1040, line 11 and Foreign Income Exclusion Amount can be found on Schedule 1, Line 8d.

2028-29 FAFSA Income Limits

by marital status and family size for the lower 48 states

| Family size | unmarried parent with 2026 AGI + foreign Income Exclusion amount at or below | Married parent with 2026 AGI + foreign Income Exclusion amount at or below |

|---|---|---|

| 2 | $48,690 | N/A |

| 3 | $61,470 | $47,810 |

| 4 | $74,250 | $57,750 |

| 5 | $87,030 | $67,690 |

| 6 | $99,810 | $77,630 |

| 7 | $112,613 | $87,588 |

| 8 | $125,370 | $97,510 |

| For an unmarried parent, the AGI + Foreign Income Exclusion Amount threshold is based on 225% of the 2026 federal poverty level, given family size. | For married parents, the AGI + Foreign Income Exclusion Amount threshold is based on 175% of the 2026 federal poverty level, given family size. |

TIP: Your Adjusted Gross Income can be found on your personal tax return, 1040, line 11 and Foreign Income Exclusion Amount can be found on Schedule 1, Line 8d.

2) Parent’s income is less than $60,000

There are two parts to this qualification.

- The parent’s combined AGI (Adjusted Gross Income) is less than $60,000.

- The parent filing taxes must also meet additional criteria beyond the income threshold, filing what is considered a simplified return. In this case, the parent must not file Schedules A, B, D, E, F, or H or not file a Schedule C with net business income greater than $10,000 of either loss or gain.

3) Anyone in the student’s family qualified for a means-tested Federal benefit program

If any member of the student household qualified for a means-tested federal benefit at any time in the two years prior to receiving financial aid, the parent is exempt from reporting assets. For example, the years counted for the 2026-27 FAFSA would be 2024 and 2025.

The means-tested federal programs included are:

- Earned income tax credit (EITC)

- Federal housing assistance

- Free or reduced-price school lunch

- Medicaid

- Refundable credit for coverage under a qualified health plan (QHP)

- Supplemental Nutrition Assistance Program (SNAP)

- Supplemental Security Income (SSI)

- Temporary Assistance for Needy Families (TANF)

- Special Supplemental Nutrition Program for Women, Infants and Children (WIC)

Exceptions to these rules

These rules to exempt Parent Asset reporting do not apply if:

- the parent lives outside of the US, even when they file US taxes.

- the parent does not file US taxes unless they don’t file because their income is below the filing threshold.

In both cases above, the parent must still report parent assets.

How CSS Profile Colleges Count Home Equity

Many CSS Profile colleges elect to count your home equity as a parent asset when calculating your ability to pay for college, a.k.a. your Student Aid Index. Though home equity can be a factor, there are big differences in just how much of a factor it will be at a specific college, depending on its institutional financial aid policies.

When counted, your ability to pay increases by 4 – 5% of the amount of home equity included as a parent asset. Let’s say home equity included were $100,000; that would increase your Student Aid Index – or ability to pay – by $5,000.

Three approaches to using Home Equity

1) No Home Equity

Even though information about your primary home is submitted on the CSS Profile, these colleges do not factor this information in when totaling parent assets available to pay for college. Home equity does not increase your ability to pay nor impact your student’s aid eligibility.

2) Full Home Equity

These colleges believe home equity is a key part of your overall net worth. They include 100% of your home equity when totaling parent assets available to pay for college.

3) Cap Home Equity

These colleges cap the amount of home equity they count as a parent asset relative to your income. They compare the capped amount of home equity based on your income to your full home equity and use the lesser amount. When the capped amount of home equity is less than your full home equity, they will substitute that amount when counting parent assets. Here are three examples of how this calculation works.

Example 1: Amherst College

Policy: Caps home equity at 120% of parent income.

Parent income = $150,000

Home Equity (Market Value – Outstanding Mortgage/Debts) = $300,000

Home Equity Cap as a multiple of parent income (Parent income x 120% cap) = $180,000

Instead of using $300,000 of home equity, Amherst Financial Aid will substitute $180,000 of home equity when totaling parent assets as part of the net worth available to pay for college.

Example 2: Swarthmore College

Policy: Caps home equity at 150% of parent income.

Parent income = $150,000

Home Equity (Market Value – Outstanding Mortgage/Debts) = $300,000

Home Equity Cap as a multiple of parent income (Parent income x 150% cap) = $225,000

Instead of using $300,000 of home equity, Swarthmore Financial Aid will substitute $225,000 of home equity when totaling parent assets as part of the net worth available to pay for college.

Example 3: Emory University

Policy: Caps home equity at 240% of parent income.

Parent income = $150,000

Home Equity (Market Value – Outstanding Mortgage/Debts) = $300,000

Home Equity Cap as a multiple of parent income (Parent income x 240% cap) = $360,000

In this case, because the capped amount of home equity exceeds the full home equity, Emory Financial Aid will use the $300,000 of home equity when totaling parent assets as part of the net worth available to pay for college.

Understanding each college’s policy on using home equity

You can use the information below to get an initial understanding of how CSS Profile colleges will count home equity as a parent asset. Depending on your home equity and a college’s policy, home equity may be a significant swing factor in the institutional financial aid offered by a CSS Profile college.

Financial aid application process for single, separated or divorced parents

The rules and requirements for single, separated or divorced parents differ depending on the financial aid application. The information below clarifies the rules for both FAFSA (Free Application for Federal Student Aid) and the CSS Profile.

Comparison of FAFSA and CSS Profile rules for single, separated and divorced parents

This at-a-glance comparison links to more detailed explanations for each application below.

| Which parent should complete the application? | Only one parent submits information. | Both parents submit information. |

| Which parent should complete the application? | The parent who provided the greater financial support for the 12 months prior to sumbitting the FAFSA. If both parents contribute equally, then the parent with the higher income or assets. | The parent who completes the FAFSA submits the primary CSS Profile application with the student. The other parent will be invited to complete their form separately and confidentially. |

| How do we verify that one parent provided greater financial support? | FAFSA has no verification. FAFSA provides no definition or measure of what constitutes greater financial support. | CSS Profile follows same rules as FAFSA regarding what constituts greater financial support. |

| What if the other parent refuses to complete the financial aid applications? | FAFSA never requires the other parent’s information, so there is no impact. | CSS Profile colleges require both parents’ information for the student to be eligible for institutional need-based financial aid. If one parent refuses, the student will not be eligible. |

| What if the other parent does not have contact or provide financial support? | FAFSA never requires the other parent’s information, so there is no impact. | Students can ask each college to waive the requirement for the other parents’ information. A parent’s refusal to participate or pay for college is not sufficient reason for the waiver. |

Rules for 2026-27 FAFSA

Which parent completes the FAFSA?

If the student’s parents are 1. Never married, 2. Separated or 3. Divorced, and no longer live in the same household, only one parent – typically called the custodial parent – submits information on the FAFSA. However, if parents are living under the same roof, both parents will be required to submit their information regardless of marital status.

Who is the custodial parent?

The criteria FAFSA uses to determine who is the custodial parent are as follows:

- The parent who provides the greater financial support to the student in the 12 months prior to application submission.

- If the student receives equal support from both parents for that time period, then it’s the parent with the greater income or assets.

There is no basis for a parent to be the custodial parent for purposes of completing the FAFSA based on the following:

- Which parent the student lives with the most.

- Which parent has legal custody.

- Which parent claims the student on their taxes.

The custodial parent needs to create a Federal Student Aid (FSA) ID to complete and electronically sign the student’s FAFSA. Watch this short video tutorial on how to create an FSA ID.

What if the custodial parent is remarried?

A custodial parent who is remarried reports income and asset information for both themself and their spouse. This is true even if the new spouse has not adopted the student. FAFSA requires the entire household’s financial information for financial aid consideration.

Rules for the 2026-27 CSS Profile

Which parent completes the CSS Profile?

Most CSS Profile colleges will require both biological parents to submit their information, even if the parents are 1. Never married, 2. Separated, or 3. Divorced. Both the custodial parent and the noncustodial parent submit their information separately and securely into a single student application that the colleges receive. Information submitted by each biological parent is never shared with the other parent.

Who is the custodial parent?

CSS Profile follows the same criteria as FAFSA in determining the custodial parent. The custodial parent submits their information in the primary application submitted by the student. This application can be completed using the student’s College Board login, or the custodial parent can create their own College Board login. In the primary application, the student identifies their other parent, known as the noncustodial parent, and invites that parent to contribute to their CSS Profile.

How does the noncustodial parent submit her/his information?

The noncustodial parent creates a College Board login to submit her/his information. The parent links the information that they are submitting by using the CSS Profile Financial Aid ID, aka “CBFinAid ID,” associated with the student’s primary application. This ensures that the information is combined into a single application for the college. No access to this information is granted to either the student or the custodial parent.

What if either parent is remarried?

If either parent is remarried, the remarried parent reports financial information for themself and their spouse. This is true even if the new spouse has not adopted the student. The CSS Profile requires the entire household’s financial information.

What if the noncustodial parent cannot or will not submit their information?

CSS Profile colleges do not consider a parent’s unwillingness to participate and submit their information as sufficient reason not to collect this information. Non-submission by either parent prevents a college from processing the student’s financial aid application for institutional need-based aid.

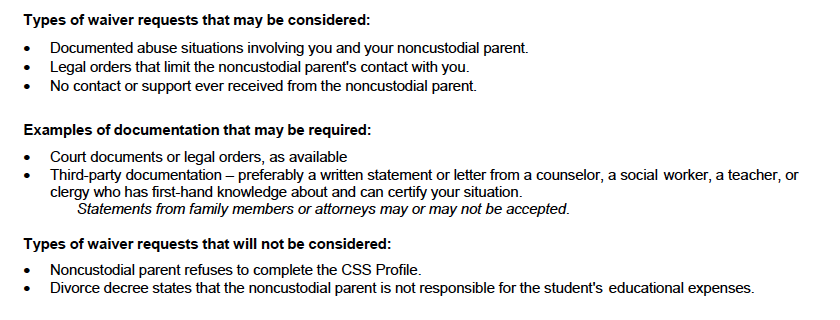

Colleges provide a formal waiver process for a student to petition for the noncustodial parent information to be omitted or waived. The waiver must be submitted separately to each college’s financial aid office, and each college uses its own evaluation process and discretion in granting a waiver.

The standard waiver request form clearly states circumstances that will and will not be considered for the waiver, often requiring “no contact” with the noncustodial parent. However, each college creates its own criteria for which circumstances to consider. Colleges may also require documentation to support your waiver.

You can review the entire standard waiver request form using the link below. Remember to check with your specific college’s financial aid office, as they may have created their own institutional waiver request form.

Resource center for divorced or separated parents on the CSS Profile website

The CSS Profile Info for Divorced or Separated Parents resource center includes several resources, including:

5 important changes coming to FAFSA families need to know

Students and parents applying for financial aid will complete a new, simpler FAFSA (Free Application for Federal Student Aid) for the 2024-25 academic year. The new FAFSA greatly reduces the number of questions and makes it easier for students and families to file.

Student Aid Index (SAI) will replace Expected Family Contribution (EFC) as the calculated amount a family is able to pay for a student’s college for a given year. Colleges will use SAI in place of EFC in the fundamental equation to determine need-based financial aid eligibility.

Cost of Attendance – Student Aid Index = Financial Need

Your financial need is the amount of need-based financial aid you would be eligible for.

Along with the new terminology, there are changes to how a family’s eligibility is calculated. Here are the five most important changes you need to be aware of and how they may impact you.

1) Elimination of the number of students in college

Change

The most discussed – and maligned – change is that the formula no longer divides Student Aid Index (SAI) by the number of students in college. Previously, the Expected Family Contribution (EFC) was calculated as a family’s ability to pay for all college costs for a single academic year. If there were multiple children in college, this EFC was then divided among those children so that each student was expected to pay a portion of the total EFC. Now, the SAI will be calculated equally for each student, except for differences in student income or assets reported between siblings.

Impact

Families with multiple children in college at the same time will see an increase in their SAI over previous years’ calculations, reducing their eligibility for financial aid.

2) Limits on income reported

Change

Income reported on the FAFSA will only come from federal tax returns. Parents (or students) will no longer be required to report untaxed or pre-tax income not captured by the tax return. Most notably, pre-tax contributions to employer retirement plans will not be counted. For student income, there is no longer the requirement to report money received or bills paid on their behalf by relatives or others.

Impact

Parents who want to lower their SAI and increase aid eligibility and may now consider maximizing pre-tax employer retirement contributions to reduce the income reported on FAFSA.

Students can now receive money from relatives – grandparents and others – to help pay for college without that support having a negative impact on their future aid eligibility.

3) Child support now reported as an asset

Change

Child support will no longer be reported as untaxed income, but instead, the amount of child support received in the FAFSA tax year will be reported as a parent asset.

Impact

Divorced parents receiving child support may see an increase in their aid eligibility since the contribution rate to the Student Aid Index (SAI) from parent assets is much lower than from parent income.

4) Value of a family business or farm is reported as a parent asset

Change

The net worth of a family business or farm of any size will now be reported as a parent asset. The current EFC formula excludes this amount if the business or farm employs fewer than 100 full-time employees, which exempted most cases. Going forward, this change may impact more small business owners.

Impact

Families who report a value to their business or farm will see a higher Student Aid Index and a decrease in their aid eligibility. It’s important to note that the total value reported will not be counted as a parent asset, but only a portion. This 2024-25 chart details how this included amount will be calculated.

| If the net worth of a business or farm is… | Then the adjusted net worth is… |

|---|---|

| Less than $1 | $0 |

| $1 to $165,000 | 40% of net worth of business/farm |

| $165,001 to $490,000 | $66,000 + 50% of net worth over $165,000 |

| $490,001 to $820,000 | $228,500 + 60% of net worth over $490,000 |

| $820,001 or more | $426,500 + 100% of net worth over $820,000 |

5) New rules to calculate an SAI equal to $0

Change

There are new thresholds for students to qualify for an SAI equal to $0 and receive the maximum Pell Grant. A parent’s Adjusted Gross Income (AGI) in the FAFSA tax year will be compared to a multiple of income for Federal Poverty Level for their marital status, family size and state of residence. If the parent’s AGI falls at or below this amount, then a student will be given a maximum SAI equal to $0 and awarded a full Pell Grant. Here is the 2024-25 chart with income thresholds by marital status and family size for the lower 48 states.

| Family size/ members of household | Single parent with AGI at or below | Married parent with AGI at or below |

|---|---|---|

| 2 | $41,198 | N/A |

| 3 | $51,818 | $40,303 |

| 4 | $62,438 | $48,563 |

| 5 | $73,058 | $56,823 |

| 6 | $83,678 | $65,083 |

| 7 | $94,298 | $73,343 |

| 8 | $104,918 | $81,603 |

SAI can also be as low as -$1,500 as a measure of extreme need. Any student whose parent is not required to file a tax return will be given an SAI equal to -$1,500; however, there are other scenarios where a student’s SAI will be less than $0.

Impact

For families with high need, a better opportunity to receive an SAI equal $0 and the maximum Pell Grant. The new methodology is more generous and flexible than today’s “automatic $0 EFC” income threshold of $29,000 or less.

Guide to creating your FSA ID

Why do you need an FSA ID?

Your Federal Student Aid ID, or FSA ID, is an identity-verified ID with the Department of Education. An FSA ID is required by each FAFSA contributor to:

- Access the online FAFSA,

- Provide consent to the IRS to share your Federal Tax Information with the Department of Education,

- Electronically sign the FAFSA for submission.

You’ll use this same FSA ID to reapply for financial aid every year and manage the Federal Student Aid you may receive, such as Direct Federal Student Loans. Once created, your FSA ID will be your forever ID for all things related to the FASFA and Federal Student Aid.

You can create an FSA ID at: https://studentaid.gov/fsa-id/create-account/launch.

Who creates an FSA ID?

For a dependent student applying for financial aid, both the student and parent create their own FSA IDs. If the parent or student already has an FSA ID from prior applications, that FSA ID is used this year and every year.

Dependent student with married parents

If the dependent student’s biological or adoptive parents are married, here are the rules for which parents create an FSA ID for the FAFSA.

If parents file taxes “Married filing jointly.”

Only one parent needs to create an FSA ID.

If parents do not file taxes “Married filing jointly.”

Both parents need to create FSA IDs.

Dependent student with separated or divorced parents

If the dependent student’s biological or adoptive parents are separated or divorced and no longer live together, only the custodial parent is required to complete the FAFSA. However, if the divorced custodial parent is remarried, they must include their spouse on the application. Refer to rules on how to determine who is the custodial parent.

If the custodial parent is not remarried.

Only the custodial parent needs to create an FSA ID.

If the custodial parent is remarried and files taxes “Married filing jointly” with their spouse.

Only the custodial parent needs to create an FSA ID.

If the custodial parent is remarried and does not file taxes “Married filing jointly” with their spouse.

Both the custodial parent and spouse need to create FSA IDs.

How do you create an FSA ID?

Go to: https://studentaid.gov/fsa-id/create-account/launch.

Watch this quick, 5-minute video to create your FSA ID.

New paths to excluding parent assets from eligibility calculation

Parent assets reported on the FAFSA impact a student’s aid eligibility. For many families, the amount parents are expected to contribute from assets reported can be as high as 5.64% per year, with a rough average of 5%. Given this, the ability to exclude assets from the calculation of the Student Aid Index can be helpful to maximize eligibility.

These are the three scenarios where a parent is exempt from reporting parent assets.

The exceptions to these scenarios are if:

- the parent either lives outside of the US, even when they file US taxes

- the parent does not file US taxes unless they don’t file because their income is below the filing threshold.

In both cases above, the parent will still be required to report parent assets.

1) Student is eligible for the Maximum Pell Grant

Students may be automatically eligible for the Maximum Pell Grant given new rules on parent AGI, family size and state of residence. In the application process, FAFSA will determine whether the student qualifies for the Maximum Pell Grant based on the 2022 AGI shared by the IRS before additional financial information is reported.

Here is the chart with income thresholds by marital status and family size for the lower 48 states.

| Family size/ members of household | unmarried parent with AGI at or below | Married parent with AGI at or below |

|---|---|---|

| 2 | $41,198 | N/A |

| 3 | $51,818 | $40,303 |

| 4 | $62,438 | $48,563 |

| 5 | $73,058 | $56,823 |

| 6 | $83,678 | $65,083 |

| 7 | $94,298 | $73,343 |

| 8 | $104,918 | $81,603 |

2) Combined parent income is less than $60,000

There are actually two parts to this qualification.

- Parents’ 2022 combined AGI (Adjusted Gross Income) is less than $60,000. AGI is reported on page 1 of the 2022 1040 on line 11.

- Parents filing taxes must also meet additional criteria beyond the income threshold. For 2022, parents must not file Schedules A, B, D, E, F, or H or not file a Schedule C with net business income greater than $10,000 of either loss or gain.

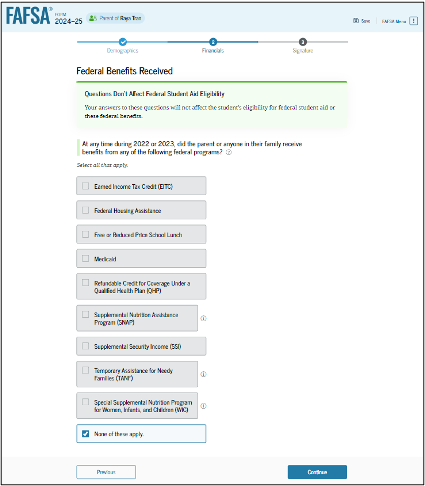

3) Student or parents receive a benefit under the means-tested Federal benefit program during the 2022 or 2023 calendar years.

Programs listed on the 2024-25 FAFSA that qualify are:

- Earned income tax credit (EITC)

- Federal housing assistance

- Free or reduced-price school lunch

- Medicaid

- Refundable credit for coverage under a qualified health plan (QHP)

- Supplemental Nutrition Assistance Program (SNAP)

- Supplemental Security Income (SSI)

- Temporary Assistance for Needy Families (TANF)

- Special Supplemental Nutrition Program for Women, Infants and Children (WIC)

RETURN TO THE COUNSELOR RESOURCE CENTER >>>

Changes to reporting parent assets

Parent assets reported on the FAFSA impact a student’s aid eligibility. For many families, the amount parents are expected to contribute from assets reported can be as high as 5.64% per year, with a rough average of 5%. The values of any reported assets are the values on the filing date.

There are three notable changes to reporting parent assets on the 2024-25 FAFSA.

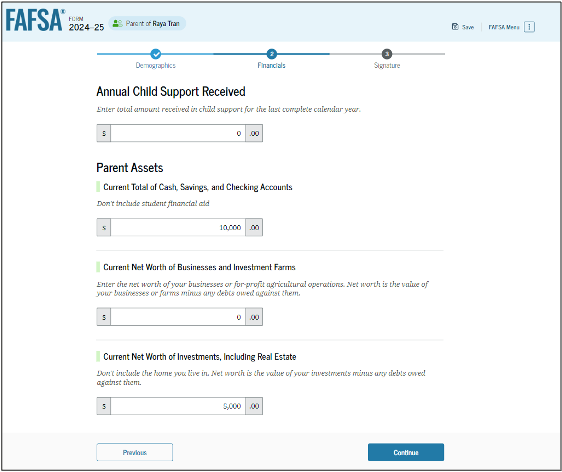

1) Child support received

If the parent received child support for any of their children, that amount is now reported as a Parent Asset instead of parent untaxed income.

How does the parent calculate the amount of child support received?

2024-25 FAFSA asks for the total child support received in the full calendar year before the application is submitted. This may not be the same as the 2022 tax year used for the 2024-25 FAFSA. For example, if the parent is completing the asset section in January 2024, then the parent should report the total child support received in 2023, not 2022.

2) Business or farm owners

The net worth of a business or farm of any size is reported under Parent Assets. Previously, if the business or farm employed fewer than 100 full-time employees, that business or farm was exempt from reporting. This is no longer the case. This new requirement will have a large impact on some families.

How does the parent calculate the net worth of their business or farm?

Based on 2024-25 FAFSA guidance, net worth of a business or farm is the value of the business or farm minus (-) debts.

- The value of the business or farm includes the market value of land, building, machinery, equipment, and inventory.

- Debts of the business or farm are only debts where the business or farm was used as collateral.

What if the parent’s business is a services business, e.g., consulting, cleaning, etc…?

Most services businesses do not have tangible assets, like land or equipment, defined in the FAFSA. In this case, the business value may be $0.

3) 529 Plans owners

Starting with the 2024-25 FAFSA, parents should only report 529 Plans that benefit the student applicant. 529 Plans that benefit or are intended for siblings or other family members are no longer reported.

What if the parent has a college pre-paid plan?

College pre-paid plans are treated the same way as 529 Plans. Parents should only report the refund value of the student’s college pre-paid plan.

What are other parent assets reported on the FAFSA?

Reportable parent assets include the following:

- Amount of cash, savings and checking.

- Amount of brokerage accounts, not held in retirement. These may include: money market funds, mutual funds, stocks, bonds, and stock options.

- Certificates of Deposits (CDs).

- Educational savings accounts for the benefit of the student applicant, including: 529 college savings plans, Coverdell savings accounts, and the refund value of prepaid tuition plans.

- Commodities.

- Net worth of second properties. Net worth would be calculated as market value of a property minus (-) any debts owned against them.

What parent assets are not reported on the FAFSA?

Parent assets that should not be reported are:

- Primary home

- Retirement accounts, including: 401k, 403b, IRA, Roth IRA, Keogh plans, pension funds and annuities

- Value of life insurance

- ABLE accounts

RETURN TO THE COUNSELOR RESOURCE CENTER >>>

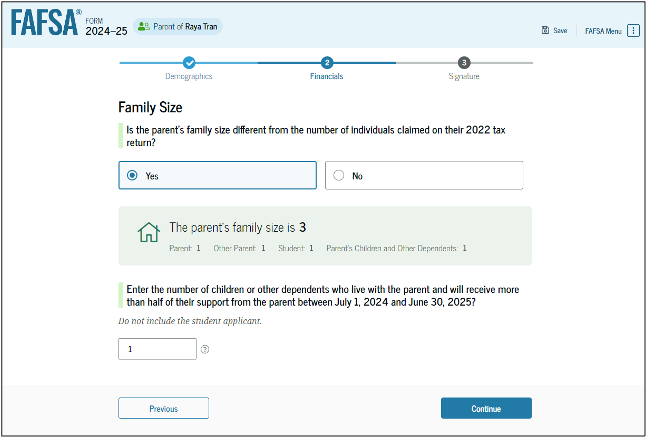

Changes to reporting family size

The family size, previously known as household size, will now be determined by the number of dependents claimed on the parent’s 2022 tax return. This number is part of the Federal Tax Information (FTI) shared by the IRS, so it will not be shown to the contributor on their application. The contributor can manually enter their own number in family to override that number shared by the IRS.

Does FAFSA want the number in family at the time of application or in 2022?

The number in family includes dependents living in the household that receive at least 50% of their support from the parent and will continue to receive at least 50% of support from the parent in the coming academic year (2024-25) when the student is in college. This can include non-children dependents like relatives and children who don’t live in the household because they are also attending college.

If the number isn’t shown, how does the parent know if it’s correct?

The parent can look at their 2022 tax return to total the number in family received from the IRS. The total is the parent or parents filing the return plus the number of dependents listed in the “Dependents” section on 1040, page 1.

Can the parent manually enter the number in family to be safe?

Many college access professionals suggest manual entry because of the many cases that there can be differences between the tax return and the actual number.

If the parent overrides the number in family from what is transferred, will this trigger a verification?

The Department of Education has stated that their standard verification will still be statistically driven, not driven by a manual entry of the number in college. This will not be considered “conflicting information” that a Financial Aid Administrator would be required to verify.

RETURN TO THE COUNSELOR RESOURCE CENTER >>>

Federal Student Aid (FSA) ID required for every FAFSA contributor

Starting in 2024-25, every contributor to the FAFSA must have an FSA ID to complete their portion of the FAFSA. Contributors will go through multi-factor verification, like a push text to their phone or email to their inbox, every time they log in.

Why is every contributor now required to have an FSA ID?

The new FAFSA is an identity-based application, meaning that each contributor’s identity must be verified to process the application and for the student to be eligible for Federal Student Aid. When a contributor legally agrees to share Federal Tax Information (FTI), the IRS must know that the person giving that permission is who they say they are. This is true even if the contributor has no FTI to be shared.

How does a contributor create an FSA ID?

A contributor must have a Social Security Number (SSN) and a unique email address. The process takes a few minutes; however, the match with the Social Security Administration can take 3-5 days. For more information, see How to Create your FSA ID.

What if a contributor doesn’t have a Social Security Number?

The Department of Education is currently setting up an alternate way for a contributor without an SSN to verify their identity and create an FSA ID. This will be through TransUnion using their “knowledge-based” identity verifying process. Current timing on the availability of this alternative method for creating an FSA ID is October 2023.

Does a contributor have to wait until the 2024-25 FAFSA is released to create their FSA ID?

No. If a contributor has an SSN, they can proactively create their FSA ID today.

If a contributor already has an FSA ID, can they still use this for the new FAFSA?

Yes. The FSA ID is a unique, life-long identifier for an individual for any engagement or interaction with Federal Student Aid.

What if a contributor can’t create an FSA ID or doesn’t want to be identified?

There will still be the option to complete a paper FAFSA. However, this paper FAFSA still requires both consent for the IRS to share Federal Tax Information (FTI) and signature to complete the application. The Department of Education will make an effort to go through the identity-verifying process once the paper FAFSA is received.